We can ignore reality, but we cannot ignore the consequences of ignoring reality

- Ayn Rand

The economic data that's been released for December and January now appear to be confirming my view that the economy hit a wall in November. As I suggested here: Expect A Decline In Auto Sales Going Forward, auto sales would start to plummet this year. Based on today's auto sales report for January, I may be on the right track. Ford's sales were down 7.5%, GM down 12% and Chrysler was up 8%. Note that Chrysler's sells the least number of cars of those three. Toyota's sales dropped 7.2% and Volkswagon's fell 19%.

The bad weather excuse just does not hold water. What makes it even more absurd is the fact that private construction spending - i.e. housing and commercial real estate - increased a little in January. Wall Street analysts and financial media reporters want me to believe that the same weather across the entire country that didn't prevent outdoor construction spending prevented people from looking for new cars? Really? Just for the record, I bought a new (used Subaru WRX) in January and I was test-driving in 20 degree weather right after a big snow storm.

And what about the plummet in manufacturing? The ISM manufacturing index registered its biggest miss of expectations on record for January and the new order index plummeted the most since 1980: Bad Weather Inside? Is Wall Street going to explain to us that leaky factor roofs and broken heating systems prevented factories from operating during bad weather days in January? Well the Purchasing Managers manufacturing index also missed expectations and the sub-indices for new export orders and order backlogs slipped below 50, indicating a contraction. Hmmm...did bad weather prevent purchasing managers from picking up their office phone and placing new orders?

The truth is that the consumer is done. According to reports from insiders at Dell, they are getting ready to cut 15,000 from the workforce. Several major retailers are chopping heads and closing stores. JC Penny and Sears are fighting off bankruptcy. The economy is in big trouble and Wall Street wants us to believe that bad weather is the culprit. George Orwell is looking down on us from somewhere in the heavens with a giant grin on his face.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

what excuse will they give during the summer months-- a heat wave caused people not to spend money? LOL.

ReplyDelete(Quinn)

ReplyDeleteI wish the government would just start blaming things on Santa. You know, "It too cold for Santa to shop this year", "Rudolph was too sick to fly" type stuff. At least we could all get a good laugh out of the BS.

Dave, what are you thoughts on the biggest current threat being US banks' derivative exposure to the Emerging Markets? Could it be that our stock market can sustain the hit for a while but the financial system could melt down in the meantime from cascading counterparty defaults when derivatives blow up?

ReplyDeleteWe saw what happens when derivatives go bad in 2008: Bear, Lehman and AIG/Goldman. AIG/Goldman was the biggest and worst and they were saved instead of Bear and Lehman because of who was sitting in the Secretary of Treasury's top seat at the time and because Robert Rubin controls Tim Geithner - who was head of the NY Fed at the time.

DeleteI'm just theorizing that the EM currency melt-down has triggered a big derivatives problem, but there's plenty of indicators that something related to derivatives is going on, like negative short term t-bill rates and the stock market drop.

There's definitely something lurking behind the scene that is creating some panic with smart money.

Blackstone, Och-Ziff Probed Over Libya Dealings

ReplyDeleteFeb 3 2014 | 3:58pm ET

The Blackstone Group and Och-Ziff Capital Management have become ensnared in the U.S. government's widening probe into alleged bribery at Libya's sovereign wealth fund.

The investigation began as a Securities and Exchange Commission civil probe into Goldman Sachs' relationship with the Libyan Investment Authority, which has sued the bank over losses suffered during the financial crisis. The inquiry has grown into a criminal investigation by the Justice Department into Goldman, Blackstone, Och-Ziff, Credit Suisse, JPMorgan Chase and Société Générale, The Wall Street Journal reports.

At issue is whether any of the firm paid bribes to LIA officials, which is barred by U.S. law. The firms were among those that sought to attract Libyan business around the financial crisis, after the country, long an international pariah, had moved to improve its relations with the U.S. and other western countries. Alleged evidence of wrongdoing emerged following Libya's 2011 revolution, which overthrew longtime military ruler Muammar Gaddafi.

The Justice Department is investigating the role of so-called "fixers" who linked investment firms with members of the Gaddafi regime, acting similarly to placement agents. Prosecutors are working to determine whether those "fixers" passed illegal payments on to Libyan officials.

http://www.finalternatives.com/node/26015

whatever happened to their gold????they really cut this country's assets up nicely.

The Baltic Dry Index must have declined from rough seas in January...... too bad about The Old Man(ning) and the Sea(hawks)

ReplyDeleteLOL

DeleteNOW do you have any respect for Sherman? With Peyton SB record for most pass completions he didn't throw much toward Sherman's way.

DeleteHopefully Dave articles are more accurate then his predictions on the Denver Broncos. Last year he picked them to go the Super Bowl and they lost to the Baltimore Ravens. Sunday night Super Bowl wasn't just a loss but a good old ass whipping. Peyton Manning despite all the glory he gets thru out the regular season doesn't show up in the big games.

ReplyDeleteOh well, a tad unlucky with football pick (yikes, I lost a Benjamin myself) but absolutely golden with economic analysis.

DeleteYou can blame Manning but this was a total team loss if I ever saw one. Complete breakdown from offense to defense to special teams.

DeleteStill waiting to hear what the two "X Factors" are. Maybe he's afraid of looking stupid in retrospect? Very sneaky to promise it "after the game" like it was a big secret...probably didn't exist at all.

ReplyDeleteAn "x" factor is something that could make difference that no one is talking about. The "x" factors clearly were not factors. I'll save 'em for next season.

DeleteNice weasel out. There never was an "X" factor and whatever you THINK you knew, you either didn't know or the handicappers also knew it. Trust me - they know a LOT more about handicapping than you do. Stick to your day job.

DeleteIf Horus had his way, the mane stream media and their paid trolls would cannibalize the entire blogosphere, just as their patrons have gutted the economy.

ReplyDeleteInstead of a rollicking halftime show for the Superb Owl, the Roman calendar year has begun by showing that packs of wild horses in media, politics, finance, etc., contain Dark horses, White horses, Trojan horses, Leaping horses.

Horses of a different color.

All while the main herd is too busy beating a dead horse.

It's never easy changing horses in midstream.

And going back to the horse and buggy is as probable as confining Mad Max to the Thunderdome.

So the entourage of the presiding high rolling, fast buck horse thieves, will be bucked off, stampeded off a cliff, or put out to pasture, depending on their stake in the game.

Quit horsin' around

DeleteExactly, y'all please get off your high horse.

Delete"Quit" backing the wrong horse.

A'int THAT good horse sense.

Not to worry. Housing is going to lead us to a new prosperity. LOL! Fell out of my chair when I saw the latest stats on distressed sales. For all the talk about a 'recovery', this is looking more and more like housing bubble 2.0.

ReplyDeletehttp://aaronlayman.com/2014/02/warped-manipulated-flipped-distorted-the-new-u-s-housing-market/

Good read!

DeleteWould you like to buy a house for one dollar? If someone came up to you on the street and asked you that question, you would probably respond by saying that it sounds too good to be true. But this is actually happening in economically-depressed cities all over America.

ReplyDeleteThis piqued my curiosity, so I started doing some research and I discovered that homes all over the nation are being sold off for a dollar or less. The following are just a few examples...

http://www.zerohedge.com/news/2014-02-03/you-can-buy-house-one-dollar-or-less-economically-depressed-cities-all-over-america#comment-4399162

Bill Black: Jamie Dimon’s $10 Million Raise is a “Common Sense” Fraud Reward

ReplyDeleteConcluding Thoughts Addressed to the Media and the Public

The question I end with for Larcker, Stewart, Sorkin, and White is what would it take? How many frauds does JPM get? When I note that JPM has been engaged in 15 separate violations of the law according to investigators, I do not mean that they have committed 15 felonies. Each of the 15 violations is very large and about half of them are among the largest fraud schemes in history. We are discussing a bank whose leaders have created the perverse incentives and corrupt tone at the top that have produced hundreds of thousands of felonies by JPM’s officers and employees. Tens of trillions of dollars in transactions were affected by their frauds.

I can understand why you have to carefully strip these realities from your reportage in order to serve as Dimon’s sycophants, but I ask you to stop. When you tell your readers that Dimon is the best bank CEO in the world how do you overcome your gag reflex? You cannot continue to make the coverage of Dimon and JPM an ethics-free and fraud-free zon. You do too much damage to the truth, the reputation of your employers, and our Nation. We cannot afford your continued race to the bottom. You need to commit to a competition in integrity.

http://www.nakedcapitalism.com/2014/02/bill-black-jamie-dimons-10-million-raise-common-sense-fraud-reward.html

Bloomberg’s Glitch Highlights Larger Issues

ReplyDeleteISDA claims its documents should be the market “standard.” That position has left investors who accepted ISDA’s narrative at a disadvantage. Moreover, ISDA has consistently demonstrated lack of vision when it has come to the dangers posed by counterparty risk and the credit derivatives market in general. There have been many examples over the years. Here’s just one from January 2008, less than nine months before the global financial crisis:

http://www.tavakolistructuredfinance.com/2014/02/bloombergs-glitch-cds/

There is a recent precedent for a more shocking loss and that is Super Bowl 42. This was where the NYG beat undefeated Brady and the Patriots. The Patriots came in with a high flying offence that was grounded by the Giant defence. It took the Patriots 2 years to shrug off that loss.

ReplyDeleteNo, that's not more shocking. Why? Because on week 17 in 2007 the Giants lost 35-38 to the NE Pats. Somehow most folks didn't pay attention to that game.

DeleteThe World We Live In

ReplyDeleteWould you like an example? How about Facebook? This company sports a $150+ billion market capitalization a PE ratio of over 150 and a book value of only around $12 billion which mostly was accrued from their IPO proceeds. This puts them at the doorstep of the 20 largest companies in the U.S. and amongst the top 50 in the world by market capitalization! Really? If Facebook all of a sudden “went away” in a puff of smoke would the world really change that much the following day? Yes there would be “withdrawal symptoms” displayed by some but it wouldn’t be like flipping a light switch only to find that there is no more electricity. Or walking into your garage and out onto the street to find that all automobiles have vanished. How about global cell phone service going down and not coming back up? How would the world change the following day? But Facebook having a top 20 market cap? Is something like that with such a small tangible book value really so indispensable that it should be included in the top 20 companies…by “value?”

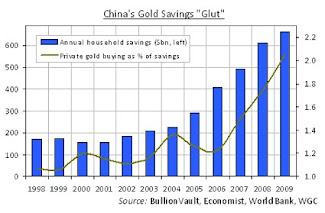

On the flip side of Facebook is the mining industry. I say “flipside” because Facebook is something that is perceived to be indispensable yet isn’t and the mining industry is viewed to have zero necessity at all but actually will be seen as the foundation to the global financial system after the great unwind. The market caps of the entire global precious metals mining industry is roughly $300 billion or double that of the single company Facebook.

Have you ever seen a gold or silver mine before? I’m sure that you have…in pictures on the internet but to see just one single mine operation in person is a different experience. The amount of land, equipment, labor and thus the capital required to pull ounces out of the ground… the enormity, is awe inspiring! Just one single mine operation, and many companies have several mines worldwide so you would need to multiply the “awe” several times for just that one company and then many more times for the total # of companies. When you add all of these together you get a whopping “$300 billion?”

http://blog.milesfranklin.com/the-world-we-live-in

Now if only the American people would come to arms the way they did on the Sea Hawks side answering the 12th man call.

ReplyDeleteHeck we even had airplanes flying over our town pulling a huge banner with the number "12" on it.(live close to Giant stadium)

Every time Manning was ready to get the ball hiked to him the roar from the crowd got loud.

We need a 12th man plan against all the crap that we're facing day in and day out !

You could not have chosen a better car for the area you are living in!

ReplyDeleteI can't believe how much torque the engine has. It's almost as fun to drive as a 911 but 1/5th the cost of maintenance.

DeleteLegendary performance to price ratio, a great value and gem! Bulletproof reliability, and also a beast in disguised. Enjoy responsibly! Subaru's one of the few automaker enjoying increase in sales YOY.

DeleteAngloGold sees reef-boring technology doubling mines life

ReplyDeleteThe gold miner plans to extend the life of its South African mines by as much as 30 years using reef-boring technology

“South Africa is going to long outlive me and probably the next five CEOs of the company,” he said at a mining conference. “Our resource base is 70 to 100 million ounces. Even if you assume half of that comes on to the books, or a third of it, it doubles the lives potentially of our South African operations.”

The boring machines, which AngloGold has developed with its suppliers, are able to remove just the gold-bearing ore from the reef, replacing it with cement and chemicals that stabilize the mining structure. Using technology rather than manual labor means the Johannesburg-based company can operate 24 hours a day.

The machines “enable you to go into mined-out areas where you otherwise wouldn’t go,” Venkatakrishnan said. “Effectively gold that is written off comes back into the books.”

http://www.mineweb.com/mineweb/content/en//mineweb-featured-news?