Eric Dubin of The News Doctors and "Doc" of Silver Doctors invited me to chat about the precious metals and housing markets the the other day. One of my main themes with respect to the markets since 2008 is that the Federal Reserve and U.S. Government have implemented an historically unprecedented degree of intervention and attempted control over our markets. They are interfering in all of the markets, but especially and specifically the precious metals, housing and stock markets.

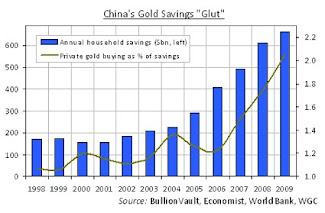

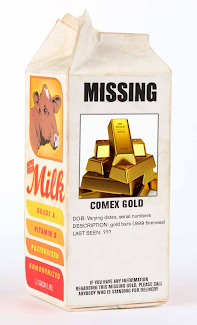

As everyone with a basic education knows, all Governmental attempts to control markets have always ended in disaster. Currently the U.S. stock markets - the Dow, S&P 500 and Russell 2000 - are now the most overvalued they've been in history. The housing market has been artificially pumped up with price inflation that will soon reverse - hard. And gold and silver have been pushed down in price to a level which has created an enormous demand for physical gold from China that has to be delivered. This has triggered a global shortage of physical bullion. The latter point is best exemplified by the U.S. Government's de facto default on Germany's request to repatriate part of its gold held in NY by the NY Fed.

The goal of the Fed/Government with the massive market intervention program is to drive the stock market inexorably higher and the precious metals lower as mechanism to "signal" to the world that everything is getting better when, in fact, this country is systemically collapsing. The degree of intensity behind the market interventions is directly correlated with the degree to which things are actually getting worse.

Here's my conversation with Eric and Doc in which we discuss the gold/silver markets, including China's incredible demand for physically delivered bullion, and what's next for the housing market:

In terms of what occurred this morning - with no associated news that would have triggered a deep plunge in gold and silver via the Comex paper markets - the action today tells us how "stretched" the gold market is to the short side in paper shorts vs. physical delivery demands coming from China and soon will be coming from India again. For as stretched as the sentiment and short side is with regard to bearish positions in the metals, the sentiment and leveraged long position is stretched to the bullish side in the stock market.

When the trigger is pulled that unwinds this historically unprecedented set-up in both markets, the stock market will collapse worse than in 1929/1987 and the metals will make a move that will cause a lot people on Wall Street and, hopefully, DC to jump out the window.

Tuesday, December 31, 2013

Monday, December 30, 2013

The Government's New Home Sales Report Was A Total Fraud - Here's Why

Last week the Government's Census Bureau issued its monthly new home sales report for November. Not only is the Government asking us to believe that the number of new homes sold in November - historically one of the slowest months of the year for home sales - exceeded the new homes sold in June, which is the highest month for sales, but it put in enormous upward revisions to the numbers originally reported for September and October. Hmmm...

I wrote an article which runs through why it's not possible that the Government's numbers are even remotely close to being credible. The two primary reasons are that mortgage applications and existing home sales tanked hard during the period in which the Government is now asking us to believe that new homes sales were at their highest of the year. Here's the full analysis: More Government Data-reporting Fraud

It's beginning to smell a lot like Orwell's Ministry of Truth in "Animal Farm," isn't it?

I wrote an article which runs through why it's not possible that the Government's numbers are even remotely close to being credible. The two primary reasons are that mortgage applications and existing home sales tanked hard during the period in which the Government is now asking us to believe that new homes sales were at their highest of the year. Here's the full analysis: More Government Data-reporting Fraud

It's beginning to smell a lot like Orwell's Ministry of Truth in "Animal Farm," isn't it?

Thursday, December 26, 2013

War On Terror?

As it turns out, the U.S. Government is the most deadly terrorist in the world. Here's an example that the people who still support Obama either look the other to or don't have a problem with.

U.N. experts urge U.S., Yemen to explain erroneous drone strikes:

The U.S. military actions can not be blamed on the Republicans because Obama, as Commander-In-Chief, has the ability to stop all of it. He promised to stop a significant amount of when he was campaigning in 2008. As it turns out, he has done nothing but escalate it. Anyone who still supports Obama is supporting the most dangerous terrorist country in the world.

U.N. experts urge U.S., Yemen to explain erroneous drone strikes:

United Nations human rights experts told the United States and Yemen on Thursday to say whether they were complicit in drone attacks that mistakenly killed civilians in wedding processions this month.What a nice holiday present from Barack and Michelle to the citizens of Yemen...That's from a Reuters news report, in case the Obama supporters want to blame it on the Republicans or blame it on an unreliable news source: Drone-happy Barack. Here's an estimate of the civilian drone deaths since Obama took office just in Pakistan: From The Left-Leaning Huffington Post.

The U.S. military actions can not be blamed on the Republicans because Obama, as Commander-In-Chief, has the ability to stop all of it. He promised to stop a significant amount of when he was campaigning in 2008. As it turns out, he has done nothing but escalate it. Anyone who still supports Obama is supporting the most dangerous terrorist country in the world.

Tuesday, December 24, 2013

Today's New Home Sales Report For November: Complete Fiction

I'll have a lot more in-depth detail in a couple days, but suffice it to say that today's new home sales report, prepared and released by the Government's Census Bureau, goes beyond the bounds of all credibility.

Please note: the headline number is a seasonally adjusted annualized number. We have no idea how they statistically engineer that final number but there's no way it's even remotely accurate. To begin, the Government significantly revised higher the numbers originally reported for September and October. Does it make sense that October had new home sales that were higher than for June - June being the seasonally strongest month for home sales? It gets better. Based on the revised numbers for Sept/Oct plus today's number for November, the 3 month average for Sept-Nov was a 447,000 seasonally adjusted annualized rate. It exceeds the 3 month average for June- Aug by 44,000. Is it even possible for that to happen considering the strong seasonality of housing, with June-Aug being by far the strongest seasonal months? Sorry the numbers are not believable.

Layer onto that the Government shut-down, which seems to have affected every business statistic out there negatively except a few that are being reported by the Government. In addition, mortgage purchase applications have plunged over the last three months. Purchase applications have declined in 9 of the last 13 weeks. How can new home sales possibly be higher when 90% of all new homes are purchased using mortgages? If you take just the estimated actual number for November of 33k homes sold and simply annualize it, you get a 396,000 annualized rate. This would overstate the actual rate because November is typically a slow seasonal month. I have no idea where the Government's 464,000 estimate came from and I doubt anyone else does either.

Getting back to mortgage applications, here's a chart for purchase applications (source: Calculated Risk blog):

The Government wants us to believe that new homes sales increased despite that sharp fall off in applications for mortgages used to purchase new homes, which finance 90% of all new home sales. Finally, interest rates have been climbing steadily higher since early October. In fact, 30-yr fixed rates have spiked up from 4.10% at the end of October to their current 4.47%. And that rate is for a 20% down mortgage and perfect credit.

So I'll leave it up to you to decide if you think the Government new housing report is even remotely believable.

Please note: the headline number is a seasonally adjusted annualized number. We have no idea how they statistically engineer that final number but there's no way it's even remotely accurate. To begin, the Government significantly revised higher the numbers originally reported for September and October. Does it make sense that October had new home sales that were higher than for June - June being the seasonally strongest month for home sales? It gets better. Based on the revised numbers for Sept/Oct plus today's number for November, the 3 month average for Sept-Nov was a 447,000 seasonally adjusted annualized rate. It exceeds the 3 month average for June- Aug by 44,000. Is it even possible for that to happen considering the strong seasonality of housing, with June-Aug being by far the strongest seasonal months? Sorry the numbers are not believable.

Layer onto that the Government shut-down, which seems to have affected every business statistic out there negatively except a few that are being reported by the Government. In addition, mortgage purchase applications have plunged over the last three months. Purchase applications have declined in 9 of the last 13 weeks. How can new home sales possibly be higher when 90% of all new homes are purchased using mortgages? If you take just the estimated actual number for November of 33k homes sold and simply annualize it, you get a 396,000 annualized rate. This would overstate the actual rate because November is typically a slow seasonal month. I have no idea where the Government's 464,000 estimate came from and I doubt anyone else does either.

Getting back to mortgage applications, here's a chart for purchase applications (source: Calculated Risk blog):

The Government wants us to believe that new homes sales increased despite that sharp fall off in applications for mortgages used to purchase new homes, which finance 90% of all new home sales. Finally, interest rates have been climbing steadily higher since early October. In fact, 30-yr fixed rates have spiked up from 4.10% at the end of October to their current 4.47%. And that rate is for a 20% down mortgage and perfect credit.

So I'll leave it up to you to decide if you think the Government new housing report is even remotely believable.

Fact vs. Fiction - Truth vs. Lies

We can ignore reality, but we cannot ignore the consequences of ignoring realityI was confronted at my tennis club last night by a guy who associates anyone who invests in gold with an obsession with doom and gloom. I guess he thinks that people who move their phony fiat U.S. dollars into gold are trying to get rich at the expense of general despair. Nothing could be further from the truth in terms of what I would like to be doing vs. what I am doing. Hell, during the 1990's I was a junk bond trader on Wall Street. Alan Greenspan's magic money printing press was my best friend. This particular guy is a real estate broker and his income is a "third" derivative benefit of money printing. Anyone who works on Wall Street in the type of job I had is not only a direct beneficiary of a promiscuous Federal Reserve printing press, but also skims 90% of that benefit - i.e. a first derivative beneficiary.

- Ayn Rand

The funny thing is, anyone who is receiving any benefit from the hyperbolic money printing going on right now is doing so at the expense of others. So the real estate broker who has seen a "pop" in commissions because the half trillion dollars the Fed has tossed at the real estate market over the last year is benefiting from a temporary and very artificial "pop" in home prices and the related temporary increase in sales volume. But what about the people who, looking back, will have significantly overpaid for their dream home when this mini-housing bubble collapses? It's starting to drop pretty quickly already. Prices from June to now in both new and existing homes have dropped every month since June (See My Article For The Data). This means that everyone who bought a home in June with a 3.5% FHA down payment mortgage is now underwater on that mortgage. I have been receiving emails from all over the country from readers describing the same kind of mess that I see all around Denver: high end homes sitting for months on the market, "for sale" and "coming soon" signs popping up like zits on a teenager and reports from real estate agents that activity has dropped off a cliff in their city.

And guess what? Interest rates are moving higher and the FHA, in a move that was not widely broadcast, is lowering the size of mortgage it will guarantee in 650 counties across the country. In some cases this reduced mortgage size will be significant, especially in the mini-bubble areas. As an example, in Clark County Nevada (Las Vegas) the limit is being reduced from $400k to $287,500. The FHA finances over 20% of the real estate market, up from about 2% in 2008, and it has filled the void created when the big junk mortgage lenders like Countrywide and Wash Mutual went bust in the big housing bubble. The FHA move will significantly curtail housing market activity. FNM/FRE are also getting ready to put the squeeze on loose lending standards, but the changes have been temporarily deferred. FNM/FRE have their own hidden landmines accumulating.

I'm not a prophet of doom and gloom, I'm trying to pull back the curtain of lies and deceit that has become endemic to our system at all levels, especially as it emanates from Wall Street, the Fed and the Government.

How about the stock market? This gentleman mocked me by asserting that the stock market was hitting all-time highs while gold was going lower. Notwithstanding all of the provable facts about the degree the Fed now intervenes in the all of the markets, let's take a look at some surface facts. 1) Every time the stock market hits an all-time high, it ultimately suffers a massive drop; 2) margin debt recently hit a new all-time high - let's see how that worked out the previous two times in the new millennium:

(click on graph to enlarge - source: greedometer.com)

That doesn't look so promising, does it? Let's layer on top of that the fact that p/e ratios are currently at all-time highs. If you strip out the phony mark to market accounting games being played by the financial sector - which represent 25% of the S&P 500 - the p/e ratios are on Pluto; 3) How about that economy? 4.1% GDP growth in Q3, eh? Well, those who bothered to look beyond the headline nonsense saw that 40% of the headline number is attributable to the massive inventory build that is going on. This inventory build up is historically unprecedented:

(click on graph to enlarge)

Not only is this inventory build-up 200% greater than at any time in the last 70 years, but it's nearly 400% greater than the average change in inventory. Even worse, every time the inventory build has spiked up like this, it's been followed by a cliff-drop decline. There are several other problematic aspects with that latest GDP report which I plan on writing about soon.

My point here is that the stock market is not only at an all-time high and at an all-time level of overvaluation, but it also reflects the extreme fraud and manipulation going on behind the headlines and rhetoric. Just a few more points of fact: The U.S. Government debt hits a new all-time everyday; the number of people receiving welfare hits a new all-time high every day; the percentage of people who are actually employed on a full-time basis as a percentage of the total population declines every day.

One last point about the economy. I had forecast back in November that we would have very disappointing retail sales this holiday season: Holiday Sales Will Disappoint. I didn't put that out there because I thrive on doom and gloom, contrary to my acquaintance's assertion. I put that out there because based on the facts that I was looking at, our economy is dropping off a cliff. Well guess what? We already know that retail sales were a bust over the Black Friday weekend. It turns out that last week through Sunday retail sales dropped 3.1% - that's before stripping out inflation - and shopper traffic dropped 21%: Retail Sales Tank Before Christmas. Just one note of observation: to the extent that online sales might be "cannibalizing" mall traffic, it's a fact that online e-commerce is only 6% of total retail sales. So don't expect a big contribution from online sales reports even though the year over year percentage headline gains will be big. As I've discussed ad nauseum, the year over year comparisons right now are exceedingly deceptive.

The point of all of this is that I don't feed and thrive on doom and gloom. What I do thrive on is trying to expose as many people as possible to the truth as supported by the facts about what is really going on in this country. What is really going on is that our system is collapsing in every aspect: economically, politically, ethically, spiritually. And I don't advocate gold because it's a way to make money off of this collapse. I advocate gold because it's the only I can see that people have a chance of surviving the economic meteor coming at our system. Anyone who superficially reads the headline business reports or looks at the stock market and thinks things are getting better is not looking at the facts as they exist and the truth as it is. My only goal is to help people see those facts and then they can draw their own conclusions about the truth.

One last point of fact: the U.S. dollar is slowly and subtly being vacated by the global monetary system while gold is slowly being re-introduced. The Chinese are leading this effort but they have a wide array of economic allies supporting the changes being implemented. Anyone who moves dollars into gold is going to be better off when the transition to the new global monetary system accelerates. The U.S. dollar, like all paper fiat currencies before it throughout all of history, will be nothing but a museum relic.

Merry Christmas to all who celebrate the holiday - to everyone else who will be going out for Chinese food tonight (a big Xmas Eve tradition in NYC) have a great day off tomorrow.

Friday, December 20, 2013

Federal Reserve Market Invtervention In Extremis

For all of you who are still trying to figure out why the stock market has shot up like a bat out of hell despite the fact that the Fed has reduced (at least temporarily) the amount of monthly money printing, please take the time to read this article written by former Assistant Treasury Secretary and highly respected academic Paul Craig Roberts: Manipulations Rule The Markets

It's no secret that the economy in the U.S. is starting to fall apart again, along with that of the rest of the world. In order for the Fed and the Obama Government to keep feeding us the lies about the economy, it is important that the Fed - in conjunction with the U.S. Treasuries Exchange Stabilization Fund - keep the stock market moving higher and the price of gold capped at an extraordinarily low manipulated level (I'm currently working on an article that will demonstrate how the Fed manipulates the gold market using Comex paper gold futures).

Meanwhile,China keeps hoovering up all of the physical gold that is being stored in NYC and London vaults: What's Happening To All The Gold? That's a video interview on Bloomberg News with an analyst based in London who recently toured the primary gold vaults in London. Guess what? They are becoming quite empty...

Finally, I just published two separate articles which explain why the housing market - based on both new and existing home sales - is getting ready to plunge back into a nasty bear again. You can read those here: The Housing Market Bear Is Growling and here: November Existing Home Sales - Look Out Below.

Based on everything I observe and research, I have two holiday recommendations: 1) if you no longer trust the Government and understand just what a Ponzi scheme our system is, start taking as much phony paper money as you can afford and quickly accumulate physical gold and silver that you keep outside of the banking and financial system - that last point is of critical importance; 2) if you think you are going to list your home for sale in mid-January and get the same price your friendly local real estate broker quoted you back in July, forget about it - get your home listed and price it to sell if you really want to move or recapture any equity value it has right now. By this time next year I believe people will be shocked at how much the housing market has fallen apart.

One more point on housing. While the FHA did not make a big public announcement about this, starting Jan 1 it has lowered the size of mortgage it is willing to guarantee in 650 counties. In some cases the reduced mortgage size is substantial. The FHA now funds over 20% of all new mortgages, including a wide swathe of subprime-quality borrowers. Essentially you can kiss that part of market demand good-bye unless prices fall by a significant amount.

At any rate, have a great weekend and if you are taking most of next week off, Buon Natale. If you are traveling, auguri e buon viaggio!

Thursday, December 19, 2013

Whatever

An old colleague and I agreed back in 2002 - back when we were one of the few who were openly discussing how corrupted and bankrupt the U.S. was - that we would eventually see things happen in this country that would blow our minds. As if to perceive just how rotten to the core the U.S. political and economic system was back then wasn't enough in and of itself to be considered mind-blowing, we knew worse was in store. 2008 and the unbelievable use of billions in taxpayer money to bail out the banks from their bad bets was bad enough. But to then watch the upper management of the banks take that bailout money and distribute a lot of it as bonus money to employees was horrifying. But I guess what's really mind-blowing is that the America public just sits there and takes it. It's the equivalent of being raped by an HIV-infected criminal and then say, "whatever.""The last duty of a central banker is to tell the public the truth" - Alan Blinder, 1994 on the PBS Nightly Business Report

Yesterday was close to be mind-blowing. The Fed somewhat unexpectedly announced that it would partially reduce its monthly money printing program starting in January. The truth there is that the Fed has been printing more than $85 billion per month when you factor in the fact that it takes interest earned on the bonds it has bought and turns around and buys more bonds from the banks. So the actual "taper" event is somewhat of a deception. But then Bernanke gets in front of the media and states that the economy is improving. Let's see, Caterpiller announced today that it's global sales plunged 12% in November; Boeing announced that it lost a $4.5 billion jet order from Brazil because of NSA spying; existing home sales for November were released and if you look beyond the headline nonsense, you'll find sales in November vs. November last year dropped 4% and from October to November this year sales plunged nearly 13% - I'll have more on this later but please note that mortgage rates have been dropping, so the NAR cover story of higher rates is total b.s. There were some other negative surprises released today as well. How's that look for Bernanke's dishonest report on the condition of the U.S. economy?

But don't take it from me, if you think Bernanke means well - he doesn't - here's an excerpt from the widely read King Report:

In his press conference Bernanke reiterated the FOMC Communique’s false narrative that persistently low inflation could harm the economy. We cannot believe that Fed academics still believe in the economic alchemy that holds that economic growth is related to inflation. Fed academics, like Soviet apparatchiks, have purged the economic history of the Seventies, Eighties and late Nineties in order to maintain the promiscuous credit policies that keep big banks and big government functioning.The market action after the FOMC statement was equally as absurd. Here's another comment from The King Report:

Please note that the initial response to Fed tapering drove the S&P 500 below and important technical level (or two) and someone immediately appeared to rescue stocks by driving SPHs higher. We have warned incessantly that this scheme has occurred repeatedly since the financial crisis of 2008.The Fed and the Government have unleashed an unprecedented amount of manipulative control over the markets - all of them, not just the precious metals market.

Perhaps Bernanke's greatest lie was when he stated under oath in front of Congress that he didn't understand gold and that Central Banks hold it merely out of tradition. If that's the case, Benjamin Shalom Bernanke, how come the Fed spends hundreds of thousands of dollars in legal fees fighting every Freedom of Information Act inquiry seeking to see the Fed's files with regard to its gold activities?

The truth is the Fed is absolutely terrified by gold. When the price starts to move up like it did from 2008 to 2011, it signals to the world that something is wrong. The Fed has spent considerable time and resources since September 2011 working to keep the price of gold as low as possible. More on this soon, as I'm working on an article about this. But the fact stands that what is occurring right now and has been occurring in varying degrees for decades is the extreme manipulation of gold for the purpose of defending the U.S. dollar's reserve currency status.

And if Benjamin Shalom Bernanke and Janet Louis Yellen - both Old Testament adherents - can stand in front of the public and lie about that, then they must answer to a different higher authority than most Americans...yep, whatever.

Tuesday, December 17, 2013

The Housing Market Is About To Crash

For any of you thinking that your underwater mortgage is now covered by the value of your home or for those who were thinking they would take advantage of the housing market "recovery" and sell, you better take a look at facts. The facts are not what is being reported to you by the Government, Wall Street or the various housing industry associations. The facts are what you have to dredge up by wading the through the details of housing market reports. You have to go well beneath the surface of the headline media reports and fluffed up news broadcast sound-bytes.

It just so happens that I have done that and have been doing that. And just like I warned people in 2004 that the housing market would collapse - which it started to do in mid-2005 - I am warning everyone again that the housing market is about to take a long, hard drop.

How do I know this? Because I look at the actual data that is being reported by homebuilders. Not the glossed up b.s. they present to the public at large but the actual data buried in the bowels of their SEC filings. To begin with, the upper management of just about every single publicly traded homebuilder has been dumping stock en masse. They are not buying their shares. They are either taking their stock and option bonus awards - which get filed as a purchase - and dumping them as soon as they are allowed by law or they are dumping shares outright. I publicly challenged an official at Pulte Homes to have himself and his management cronies take after-tax cash from their bank accounts and buy shares outright. That was about two months ago. Not only did he not get back to me but, in fact, insiders there are dumping. Look for yourself: Stock Bonus At Zero Cost Dumped At $18.35. They are ALL doing this.

Want to know why insiders are dumping? You can read my latest two articles in which I dredge up the real numbers here: Housing Market Bear Growls - Black Swan Coming and here: New Home Prices Falling Fast.

For those of you looking to sell your home thinking it is worth what a broker might have quoted you three months ago, forget about it. Prices of new and existing homes are falling - not year over year as reported - but sequentially month to month, starting in the early summer. It is the latter data that is relevant - not the latest month's data vs. the same month last year. My links above have some of the data to prove that. In addition, you may have noticed more "for sale" signs popping up. This shouldn't be happening in December but it is - at least all around Denver. I have received emails from all around the country with readers telling me they see the same thing where they live. My bet is that there will be a deluge of homes listed for sale in early 2014, after the dust settles from the holidays. Prices are going much lower.

It just so happens that I have done that and have been doing that. And just like I warned people in 2004 that the housing market would collapse - which it started to do in mid-2005 - I am warning everyone again that the housing market is about to take a long, hard drop.

How do I know this? Because I look at the actual data that is being reported by homebuilders. Not the glossed up b.s. they present to the public at large but the actual data buried in the bowels of their SEC filings. To begin with, the upper management of just about every single publicly traded homebuilder has been dumping stock en masse. They are not buying their shares. They are either taking their stock and option bonus awards - which get filed as a purchase - and dumping them as soon as they are allowed by law or they are dumping shares outright. I publicly challenged an official at Pulte Homes to have himself and his management cronies take after-tax cash from their bank accounts and buy shares outright. That was about two months ago. Not only did he not get back to me but, in fact, insiders there are dumping. Look for yourself: Stock Bonus At Zero Cost Dumped At $18.35. They are ALL doing this.

Want to know why insiders are dumping? You can read my latest two articles in which I dredge up the real numbers here: Housing Market Bear Growls - Black Swan Coming and here: New Home Prices Falling Fast.

For those of you looking to sell your home thinking it is worth what a broker might have quoted you three months ago, forget about it. Prices of new and existing homes are falling - not year over year as reported - but sequentially month to month, starting in the early summer. It is the latter data that is relevant - not the latest month's data vs. the same month last year. My links above have some of the data to prove that. In addition, you may have noticed more "for sale" signs popping up. This shouldn't be happening in December but it is - at least all around Denver. I have received emails from all around the country with readers telling me they see the same thing where they live. My bet is that there will be a deluge of homes listed for sale in early 2014, after the dust settles from the holidays. Prices are going much lower.

Friday, December 13, 2013

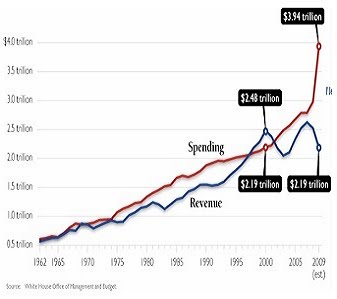

The Real Budget Deficit Was $1 trillon In The Government's Fiscal 2013 Year

Someone asked me my view of the reportedly narrowing Government spending deficit. The fact is that the Government uses gimmicks in order to move expenditures "off budget" in order to hide the truth (imagine that...). Notwithstanding this, we can get a pretty accurate accounting of the actual cash in/cash out spending deficit by measuring the change in Government debt outstanding during any Fiscal Year period. To be sure, the total deficit runs in the several trillions, but this would be based on GAAP accounting of all expenses, including the accumulating entitlement expenses, which we know will never be paid.

I've outlined below why, even if you want to believe the Government's story that the deficit is narrowing, it really did not.

The budget deficit is lower this year for a couple reasons, all of them non-recurring:

1) We had a big one-time in tax revenues in December/January (remember the U.S. fiscal year starts in October) because of the tax increase in capital gains on Jan 1 triggered a wave of asset sales that generated a big jump in tax revenues. You can find charts using google that show this.

2) Removal of the Bush "tax holiday" for W-2 paycheck earners. This increased the general level of tax revenues. interestingly, the tax revenues started to decline a little over the summer and I saw a recent article that said States are seeing tax revenues from individuals decline. This clearly reflects the actual reduction in jobs/wages that is occurring.

3) One-time payments from Fannie Mae, Freddie Mac and sale of Treasury's GM stock. Non-recurring. self-explanatory EXCEPT, most of FNM/FRE income has been generated by accounting gains from both of them "marking to market" bad assets, just like the banks have been doing. I haven't studied it closely and I don't know if I will, but I would bet that FNM/FRE run into liquidity problems in 2014.

It would also make sense that Cerberus Partners is looking at buying a big stake in Fannie Mae. Cerberus took control of GMAC before GMAC went belly-up. Given they whiffed badly on GMAC, I suspect the same idiots there will repeat the same mistake again with FNM. But what does Cerberus care? It's not their money, it's the bone-headed pension fund managers that give Cerberus money to lose like that.

4) Taxes generated from real estate sales - the housing market is slowly imploding and I bet it really gets hammered in 2014.

5) We don't know to what extent budget games have been played in terms "on-budget/off-budget accounting." The truth is the only way to tell what the real spending deficit was is to see how much Treasury debt increased during a given fiscal year.

Now, here's the most interesting part: Using Treasury Direct, LINK, you can see that the Government debt increased $672 billion during FY2013. HOWEVER, remember that right after Obama signed the temporary budget deal (after the 2013 FY), the Treasury debt jumped by $328 billion. This was money SPENT that was borrowed using the "tricks" Jack Lew said he would use during the 2013 fiscal year. It was debt that would have been issued in FY2013 but the Government couldn't issue it. SO, the real spending deficit was $1 trillion even. If you add back the FNM/FRE dividends, it was over $1 trillion.

So, you tell me. Is the spending deficit really as low as the Obama Government is reporting? I bet we'll see a spending deficit well in excess of $1 trillion this year because I bet that individual tax revenues will decline because of the economy.

I've outlined below why, even if you want to believe the Government's story that the deficit is narrowing, it really did not.

The budget deficit is lower this year for a couple reasons, all of them non-recurring:

1) We had a big one-time in tax revenues in December/January (remember the U.S. fiscal year starts in October) because of the tax increase in capital gains on Jan 1 triggered a wave of asset sales that generated a big jump in tax revenues. You can find charts using google that show this.

2) Removal of the Bush "tax holiday" for W-2 paycheck earners. This increased the general level of tax revenues. interestingly, the tax revenues started to decline a little over the summer and I saw a recent article that said States are seeing tax revenues from individuals decline. This clearly reflects the actual reduction in jobs/wages that is occurring.

3) One-time payments from Fannie Mae, Freddie Mac and sale of Treasury's GM stock. Non-recurring. self-explanatory EXCEPT, most of FNM/FRE income has been generated by accounting gains from both of them "marking to market" bad assets, just like the banks have been doing. I haven't studied it closely and I don't know if I will, but I would bet that FNM/FRE run into liquidity problems in 2014.

It would also make sense that Cerberus Partners is looking at buying a big stake in Fannie Mae. Cerberus took control of GMAC before GMAC went belly-up. Given they whiffed badly on GMAC, I suspect the same idiots there will repeat the same mistake again with FNM. But what does Cerberus care? It's not their money, it's the bone-headed pension fund managers that give Cerberus money to lose like that.

4) Taxes generated from real estate sales - the housing market is slowly imploding and I bet it really gets hammered in 2014.

5) We don't know to what extent budget games have been played in terms "on-budget/off-budget accounting." The truth is the only way to tell what the real spending deficit was is to see how much Treasury debt increased during a given fiscal year.

Now, here's the most interesting part: Using Treasury Direct, LINK, you can see that the Government debt increased $672 billion during FY2013. HOWEVER, remember that right after Obama signed the temporary budget deal (after the 2013 FY), the Treasury debt jumped by $328 billion. This was money SPENT that was borrowed using the "tricks" Jack Lew said he would use during the 2013 fiscal year. It was debt that would have been issued in FY2013 but the Government couldn't issue it. SO, the real spending deficit was $1 trillion even. If you add back the FNM/FRE dividends, it was over $1 trillion.

So, you tell me. Is the spending deficit really as low as the Obama Government is reporting? I bet we'll see a spending deficit well in excess of $1 trillion this year because I bet that individual tax revenues will decline because of the economy.

Wednesday, December 11, 2013

Look Out Below

This is the type of stock market that could really start to accelerate to the downside. I woke up somewhat surprised to see the dollar had dropped to a new low for the move down it is currently making. I really expected that the news of the Congressional budget deal - as hollow and fictitious as it is - would have at least given some superficial support to the markets. But the dollar continues to fall hard - I'll have more to say about that later this week - and now the stock market appears to be on shaky ground.

The fact is that the stock market is, right now, historically overvalued. Especially in relation to the underlying fundamentals. I have been posting analysis now for about 8 weeks which shows both the auto sales and housing markets are starting to head south. Bloomberg has a report today that details falling apartment rents in NYC and that the apartment vacancy rate is back to a 7-yr high: LINK I specifically remember walking around NYC back in 2007 and was stunned by the number new building skeletons for which construction had clearly been abandoned. Sounds like now there's several new completed buildings that will sit mostly empty for quite some time, especially since we know Wall Street is about to go through a job-cutting blood bath.

I also believe that the housing market is about to head south very quickly: New Home Sales Data Show Big Problems Ahead For Housing. So, it's fine if you want to listen to the talking heads blow smoke about the economy or housing market, but at least make them back up their assertions with data. The data shows a completely different story than the fairy tale being fed to us by home sale industry organizations and the blow-hards in the financial media and on Wall Street.

In addition, Zerohedge has a report out this morning detailing the housing market collapse that has been set in motion in Nevada: LINK. Of course, as is par for course, I'm usually way ahead of Zerohedge on the topics of housing and gold. I published an article on October 29th on Seeking Alpha which cited data showing that the market for new home sales in Nevada had collapsed 60% from Q1 to Q3: Housing Market Is Headed South.

The reason NYC and Nevada are important bellweathers, at least in my view, is that both markets were among the hottest during the big housing bubble and both markets started heading south ahead of the rest of the country when the bubble collapsed. Nevada/Vegas essentially, from a demographic perspective, is East Los Angeles, so any negative trend that starts in Vegas in housing will spread to southern California like a deadly virus. This is how it played out starting in 2005 and this is how it will play out this time around. Only this time around it will be worse.

One more point about this, a colleague of mine was chatting with a realtor from Scottsdale, Arizona. That was also one of the hottest markets during the housing bubble and one of the hottest markets during this Fed and Government money printing fueled dead-cat bounce. This realtor told my colleague that the market activity in Phoenix had essentially hit a wall in November.

Be careful with your stock market exposure. No one knows for sure when, but this stock market is set up of the biggest stock market downside disaster in history.

Monday, December 9, 2013

"Who's On First?"

The central banks have now created a system which is totally dependent on ever-more credit and QE. So there is nothing that can stop them from printing money. On the contrary, they will need to print a lot more. Instead of central banks printing $2 trillion each year, it will soon be $10 trillion, and eventually a lot more. - Egon von Greyerz, King World News interview: LINKWith no meaningful Government and industry association economic reports due out today, the Federal Reserve good cop/bad cop comedy routine will be in full force today. Three regional Federal Reserve Bank presidents will be out today making their empty rhetorical speeches either in favor or against reducing QE. But all three represent nothing more than a modified Abbot and Costello slap-stick comedy routine.

The quote above represents the truth about QE. It reflects my view ever since Bernanke first uttered the word "taper" in May. That is, I said all along that the Fed has been using QE to keep the big banks solvent and the tracks in the snow leading to this conclusion are in there for anybody to examine using the St. Louis Fed data system. I connected the dots last week for everyone here: There Will Be No Taper

The other tell-tale is in the trading action of the U.S. dollar, in which the dollar looks like it has contracted that nasty new HIV strain that is resilient to treatment. I'll have more to say on this sometime this week. In the meantime, get yourself some snacks and pull up a comfortable chair so you can fully enjoy watching Bullard, Lacker and Fisher sling the bullshit around in one humorous scatological production orchestrated by the most corrupt banking system in history. Oh ya, if the brown stuff flying over the airwaves happens to cause a temporary drop in the Comex-driven paper price of gold, use that as an opportunity to add to your precious metals positions.

Friday, December 6, 2013

The "As If" Government Non-Farm Employment Report

Statism survives by looting. A free country survives by producing - Ayn Rand

What's amusing about the jobs report is that everyone discusses them as if they are valid. Even to the extent that they know the numbers are absurdly manipulated, they still dissect, analyze and discuss them "as if." It makes for terrific Broadway comedy and yet it's tragically pathetic. I laugh my ass off watching supposedly Ivy-league educated Wall Street experts get on Financial Comedy TV and opine on the latest numbers as if they are real or actually represent any semblance of truth or fact.

Today's number for instance, forget where and how the alleged job growth game from, we know that's wrong, but a much better than expected number should have sent the stock market and metals into a tailspin over the fear of a December taper. But the SPX is up 1% and the metals, after their customary "no matter what the news is bashing," are now up big from their post-report lows: up 2% for gold and 2.3% for silver.

Explain that one if the market really believes that the jobs report is valid, bona fide and truthful and if the market really believes that the Fed will taper.

The other interesting note is that the dollar soared right after the report, but it has since pulled back a stunning 36 basis points from it's high-tick today. The dollar index futures continuous contract can't hold the 50-day moving average any better than Warren Buffet can hold his bladder.

Beneath the Orwellian veneer of morose Government lies and misrepresentation, I think the market knows the truth. If not the bubblehead entitled idiots in this country, then certainly the biggest non-Japanese holders of dollars - namely the Chinese and Arabs.

I guess what would be the funniest part about the Government trying to force-feed the fraudulent data reports down our gullets like geese headed for the fois gras slaughter pen is that the average formerly middle class American is in financial pain. We see that from the plunging savings rate and soaring use of credit to try and finance the elusive and dubiously "good life" of the proverbial Joneses. By "middle class" I mean anyone not wealthy enough with cash to buy their own DC politician. That's clearly not these people who are part the 61% jump in those defaulting on luxury mortgages: Luxury Mortgage Default Rate Jumps 61%.

But the market eventually flushes out the truth, and that's becoming apparent with the decline in yesterday's consumption metric of the GDP report, with the decline in holiday retail sales and with the desperation being reflected by the preponderance of "for sale" and "coming soon" signs popping up outside of homes all over the country at the worst time of the year to sell a house.

Other than that Mary Todd, how was last night's showing of "Our American Cousin?"

Thursday, December 5, 2013

Is Atlas Starting To Shrug?

Today the Government released its second revision of Q3 GDP, which showed a big upward "revision" from 2.8% to 3.6%. These numbers are seasonally-adjusted, annualized figures which in and of themselves are highly problematic with how they are derived. Notwithstanding that, when you drill down beneath the headline reports, the components that make up GDP are downright ugly.

The revised number was almost entirely from a massive upward revision in the size of the Q3 inventory build-up by businesses. As has been written about ad nauseum, we know that retailers and auto dealers have amassed a huge amount of inventory, waiting for a recovery in consumption that will never materialize.

Speaking of consumption, that particular component of the GDP revision was revised down for a second time, 1.24% originally reported to .96% in the latest iteration. What this says is that consumption, which has been 70% of GDP for over a decade, has dropped below a 1% growth rate. If you strip out the inflation component of that growth number, it means that consumption actually declined on a real basis. In other words, unit volume sales to consumers declined. Think about that for a minute...

As you can see, unless the consumer makes a miraculous spending recovery, the economy likely has hit a wall during November. The Thanksgiving weekend retail sales reports pretty much confirm this. Although the growth in online sales has been promoted as a big positive, e-commerce represents less than 6% of total retail sales. Retail sales declined over that weekend. The consumer is tapped and so is our economy.

One last point about this, the release of today's factory orders report for October confirms my thesis here. Durables dropped 1.6% and non-durables dropped .2%. If you strip wholesale inflation out of the numbers, they are even worse. Note this: the inventory build-up that occurred in Q3 is likely going to turn into an inventory liquidation, which will negatively affect Q4 GDP. Also, this is consistent with my analysis posted yesterday which showed that the housing market is headed south.

Finally, with the headline reports bullish as they were today, shouldn't the stock market be screaming higher? The Dow is down 60 pts as I write this and the SPX is down almost .5%. Even more interestingly, the dollar has tanked hard. Theoretically, with the taper promoters out in full force today, the dollar should be screaming higher. It's not. Qu'est-ce qui se passe?

Today's action in the dollar - and this whole week for that matter - tells us the market is starting to perceive just how ugly the U.S. economic and financial situation is. No one is talking about the next budget/Treasury debt limit fight, but it's right around the corner. I think a lot of players at the dollar "poker table" are folding their cards and chairs and walking away from the game.

The Fed has no hope of reducing QE and the market is perceiving that. That's why the dollar has sold off hard this week despite the parade of positive headline economic reports. Under the hood is a different matter. Be careful with your dollar-based assets. The stock market right now is more dangerously over-valued vs. the fundamentals than it was in early 2000. I'm not the only one saying this. Jim Rogers made this statement on yesterday: "Be prepared, be worried, and be careful...this is going to end badly."

The revised number was almost entirely from a massive upward revision in the size of the Q3 inventory build-up by businesses. As has been written about ad nauseum, we know that retailers and auto dealers have amassed a huge amount of inventory, waiting for a recovery in consumption that will never materialize.

Speaking of consumption, that particular component of the GDP revision was revised down for a second time, 1.24% originally reported to .96% in the latest iteration. What this says is that consumption, which has been 70% of GDP for over a decade, has dropped below a 1% growth rate. If you strip out the inflation component of that growth number, it means that consumption actually declined on a real basis. In other words, unit volume sales to consumers declined. Think about that for a minute...

As you can see, unless the consumer makes a miraculous spending recovery, the economy likely has hit a wall during November. The Thanksgiving weekend retail sales reports pretty much confirm this. Although the growth in online sales has been promoted as a big positive, e-commerce represents less than 6% of total retail sales. Retail sales declined over that weekend. The consumer is tapped and so is our economy.

One last point about this, the release of today's factory orders report for October confirms my thesis here. Durables dropped 1.6% and non-durables dropped .2%. If you strip wholesale inflation out of the numbers, they are even worse. Note this: the inventory build-up that occurred in Q3 is likely going to turn into an inventory liquidation, which will negatively affect Q4 GDP. Also, this is consistent with my analysis posted yesterday which showed that the housing market is headed south.

Finally, with the headline reports bullish as they were today, shouldn't the stock market be screaming higher? The Dow is down 60 pts as I write this and the SPX is down almost .5%. Even more interestingly, the dollar has tanked hard. Theoretically, with the taper promoters out in full force today, the dollar should be screaming higher. It's not. Qu'est-ce qui se passe?

Today's action in the dollar - and this whole week for that matter - tells us the market is starting to perceive just how ugly the U.S. economic and financial situation is. No one is talking about the next budget/Treasury debt limit fight, but it's right around the corner. I think a lot of players at the dollar "poker table" are folding their cards and chairs and walking away from the game.

The Fed has no hope of reducing QE and the market is perceiving that. That's why the dollar has sold off hard this week despite the parade of positive headline economic reports. Under the hood is a different matter. Be careful with your dollar-based assets. The stock market right now is more dangerously over-valued vs. the fundamentals than it was in early 2000. I'm not the only one saying this. Jim Rogers made this statement on yesterday: "Be prepared, be worried, and be careful...this is going to end badly."

Wednesday, December 4, 2013

New Home Sales: Time For A Reality Check

If "cynicism" is a view of reality and truth, then "hope" is nothing but fantasy and faith - Dave in Denver...Most of you have seen or will see the media headlines broadcasting a big October for new home sales. But as is normally the case with numbers put together, manipulated and released by the U.S. Government, the report is full of serious flaws. Not only that, but if you really dig deeply into the actual monthly numbers and also consider the extreme degree of downward revisions that have been applied since at least July, the new home sales report is downright ugly. And that's not cynicism, it's fact.

It just so happens that I did the above analysis and laid out the data, facts and source citations in this article just published: Today's New Home Sales Report Is Very Bearish.

Please note that the stock market agrees with my take on the numbers, as the Dow Jones Homebuilder Index is down 1.5% right now and 2.3% from its initial spike after the report hit the tape. Furthermore, the stock market, after a big spike higher on the new homes report, is now down 10 pts as measured by the S&P 500 futures contract (front month) and 1% from its high of the day.

Be careful out there with your investments in the stock market. We are witnessing a bubble in stocks that exceeds the one in 1999 that led to the collapse in early 2000. I will note that the dollar has taken a big turn down today and gold and silver are having their best day in several weeks, with silver up over 4% and gold up 2.2%. Something ain't right out there behind the scenes.

...The power of accurate observation is commonly called cynicism by those who have not got it - George Bernard Shaw

Monday, December 2, 2013

"It's Worse Than You Think"

You can ignore reality, but you can’t ignore the consequences of ignoring reality

- Ayn RandThe title quote references the conversation I mentioned a couple weeks ago with a local businessman who knows a retired military General with ties deep into the Pentagon. The reference is to the U.S. economic and political system, not the condition of the Dept of Defense.

While the Obama regime and the elitist-controlled media seem to never fatigue from telling us that the economy is recovering, the data suggest otherwise. My latest and freshest data point is the National Retail Federation's estimate that retail sales fell 3% over the 4-day holiday weekend this year. What's remarkable, if not outright stunning, about that is the fact that this year it was truly 4 days of sales, as many big retailers opened on Thanksgiving. Given the heavy degree of discounting, and the pervasive ad campaigns advertising the deals, I don't know how you can conclude anything but that the consumer is tapped out.

But let's take a look at two more data points that come from the website of the Federal Reserve. This first graph shows a plot of real median income and the home ownership rate in the U.S (sourced from Confounded Interest blog, edits in red are mine).:

(click on graph to enlarge)

How can the economy possibly be improving when household income adjusted for the Government's low-ball inflation bogey is rapidly declining. Moreover, despite the heavy advertisements of a housing recovery, the rate of home ownership is in steep decline. Yes, I know housing prices are going crazy, supposedly, but this is largely due to a big surge in "investment" buying that has dropped off rapidly over the past few months. You can see why here, if you have not read this yet: Housing market black swan coming.

This second chart shows the rate at which the Fed is printing money - please note that the rate of increase is accelerating despite the debate over what and when "taper" means (sourced from St. Louis Fed website, edits in red are mine):

(click on graph to enlarge)

What's most interesting about this is that almost none of that money is going beyond the big bank balance sheets in the form of "excess reserves" being held at the Fed. Now, why is the Fed printing over $85 billion per month now only to have it sit collecting interesting by our Too Big To Fail banks? If you have not read this, I explain why the Fed will not taper and that I believe it's because the banks would be largely insolvent if the Fed were not injecting this kind of capital onto their balance sheet: The Taper Won't Happen, Here's Why

Circling back to my quote from Ayn Rand at the top, most people with whom I discuss the economy/system with are either unaware of just how bad things are getting or they may know but choose to bury their head in the sand and ignore it. But just because we collectively as a society choose to not look at a problem or pretend it's not there doesn't mean it will go away. In fact, based on everything I look at, except for maybe sales of high end sports cars, expensive jewelry and rare art, our system is crumbling quickly. I am willing to bet that 2014 ushers in an era of severe economic pain and Government control over our lives. Those charts above tell me I'm probably right.

Friday, November 29, 2013

"Mall Brawl Thursday" - Has It Really Gotten This Bad?

Black Friday Thursday. The entire term "holiday sales shopping" has been redefined. And the word "Black" should now be replaced with "Mall Brawl." Black Friday has become Mall Brawl Thursday. In the most obvious sign of just how desperate everyone is to keep up with the euphemistic "Joneses," what used to be a nice family holiday shopping day has turned into something out of the movie "Mad Max." Here's a nice sampling of actual videos: Mall Brawl Thursday.

Make no mistake about it, this an overt and blatant signal about just how bad our system has already deteriorated. Although it didn't start with George W. Bush, his tenure in office ushered in a transformation of our system into Rule by Fiat. The term "fiat" was originally a Latin word meaning "let it be done" and represented a decree or pronouncement by a person or Government in the position of absolute authority to enforce it. That's our Government. A Rule by Fiat totalitarian regime.

Obama refused to negotiate over the budget and debt limit deal. Why? Because somehow, hidden from view, he had the leverage to avoid compromise and the authority to force the outcome he and his handlers wanted. Now Obama is forcing Government implemented and managed healthcare down our throats. How about the way in which the NSA operates to spy on every aspect of our lives unfettered from any sort of regulation or restraint. In fact, the NSA pretty much is our worst nightmare: a known pedophile running a child daycare business out of his basement.

Throughout history, Governments move into totalitarian mode when they have lost control of the economy. Of course, if the system is free from Government control in the first place, then there's nothing of which the Government can lose control and you avoid the whole problem. But here we are now with the biggest political charlatan in the history of the United States overseeing the collapse of our system economically, socially and politically. And the implementation of Rule by Fiat is the last gasp of a Government that is letting the business and political elitists confiscate the remaining remnants of wealth that haven't been expropriated from the middle class since 1971. Note: 1971 is when Nixon destroyed any legitimate chance of our system existing as it was given to us by the Founding Fathers when he pulled the plug on any connection between gold and the U.S. dollar, thereby creating a pure fiat currency. And it's this fiat currency that belies the transformation of our Government into one of Rule by Fiat.

Another way of saying "Rule by Fiat" is "because they can." The elitists running our system and using Obama as their front-man can pretty much do whatever they want because they can. No one is even making an attempt at stopping them. The very people who are capable of stopping them are instead shooting each other at the mall on Black Thursday in order to save a couple bucks on the latest fashion sweater or electronic gadget. And Obama is the perfect front-man for them because if you disagree with anything he says or does you are branded as a "rascist."

And while Obama has been the False Prophet of Hope and Change for everyone who voted for him, the U.S. dollar represents the largest financial Ponzi scheme in history. Circling back to this new era of BlackFriday Thursday Mall Brawls, nothing could be more emblematic of the state of decline of our system or more reflective of the degree of desperation being felt by the masses than the violence precipitated by the scramble to put cheap gifts under the Christmas Tree. Is this really how Jesus would have wanted people to behave as they prepared to observe the celebration of his birth?

Think about this while the news networks coerce you to bask in the glow of the White House Christmas tree and video footage of Barack and Michelle experiencing holiday glee. They, their political colleagues and the wealthy elite do not have to worry about how they are going to try and make the holiday season joyful for their families. But what exactly did Barack do to earn this right other than sell his soul and our country out to the highest bidders?

Make no mistake about it, this an overt and blatant signal about just how bad our system has already deteriorated. Although it didn't start with George W. Bush, his tenure in office ushered in a transformation of our system into Rule by Fiat. The term "fiat" was originally a Latin word meaning "let it be done" and represented a decree or pronouncement by a person or Government in the position of absolute authority to enforce it. That's our Government. A Rule by Fiat totalitarian regime.

Obama refused to negotiate over the budget and debt limit deal. Why? Because somehow, hidden from view, he had the leverage to avoid compromise and the authority to force the outcome he and his handlers wanted. Now Obama is forcing Government implemented and managed healthcare down our throats. How about the way in which the NSA operates to spy on every aspect of our lives unfettered from any sort of regulation or restraint. In fact, the NSA pretty much is our worst nightmare: a known pedophile running a child daycare business out of his basement.

Throughout history, Governments move into totalitarian mode when they have lost control of the economy. Of course, if the system is free from Government control in the first place, then there's nothing of which the Government can lose control and you avoid the whole problem. But here we are now with the biggest political charlatan in the history of the United States overseeing the collapse of our system economically, socially and politically. And the implementation of Rule by Fiat is the last gasp of a Government that is letting the business and political elitists confiscate the remaining remnants of wealth that haven't been expropriated from the middle class since 1971. Note: 1971 is when Nixon destroyed any legitimate chance of our system existing as it was given to us by the Founding Fathers when he pulled the plug on any connection between gold and the U.S. dollar, thereby creating a pure fiat currency. And it's this fiat currency that belies the transformation of our Government into one of Rule by Fiat.

Another way of saying "Rule by Fiat" is "because they can." The elitists running our system and using Obama as their front-man can pretty much do whatever they want because they can. No one is even making an attempt at stopping them. The very people who are capable of stopping them are instead shooting each other at the mall on Black Thursday in order to save a couple bucks on the latest fashion sweater or electronic gadget. And Obama is the perfect front-man for them because if you disagree with anything he says or does you are branded as a "rascist."

And while Obama has been the False Prophet of Hope and Change for everyone who voted for him, the U.S. dollar represents the largest financial Ponzi scheme in history. Circling back to this new era of Black

Think about this while the news networks coerce you to bask in the glow of the White House Christmas tree and video footage of Barack and Michelle experiencing holiday glee. They, their political colleagues and the wealthy elite do not have to worry about how they are going to try and make the holiday season joyful for their families. But what exactly did Barack do to earn this right other than sell his soul and our country out to the highest bidders?

Wednesday, November 27, 2013

The Housing Market Approaches A Cliff

Things always become obvious after the fact

- Nassim Taleb

I issued a "sell" on the new homebuilder stocks at the end of January (Dow Jones Home Construction Index basis - DJUSHB). Since then, the DJUSHB is down 18% and has been down as much as 26%. This is a remarkable call considering that in the same time period the S&P 500 is up 20%. During this same period, homebuilder company executives have been dumping their shares at a stunning pace.

I have been postulating that what has been promoted as a housing market recovery by the financial media, Wall Street and the Obama Government is really nothing more than a dead-cat bounce in a long term bear market that has been fueled by a couple trillion in taxpayer-backed Federal Reserve and Government stimulus programs.

I have been postulating that what has been promoted as a housing market recovery by the financial media, Wall Street and the Obama Government is really nothing more than a dead-cat bounce in a long term bear market that has been fueled by a couple trillion in taxpayer-backed Federal Reserve and Government stimulus programs.

Since the beginning of the year, I have written several articles explaining how and why the housing market has appeared to be in recovery when, in fact, both price and transaction volume has been artificially manufactured through the use of direct Fed money printing, Government implemented and tax-payer financed mortgage programs and outright bank accounting and operations fraud. As for the latter, while some of the banks have been prosecuted and/or engaged in what seems to be large settlements for business and accounting fraud, they have found other ways to exploit the numerous accounting and regulatory loopholes in order to continue their schemes. As my English major adviser in college used to say, "same old wine, new bottle."

At any rate, I published an article yesterday on Seeking Alpha which shows why the housing market "bounce" is now transforming quickly into a rapid decline. Keep in mind that when you read news headlines or hear reports on financial tv, they are using year over year comparisons in order to broadcast continued "gains." As I have writing about, in order to understand what's really going now, you need to look at the month-to-month sequential comparisons. On this basis, the housing bounce topped out in late spring and has been declining since June.

You can read my latest article here: The Housing Market: A Black Swan on the Horizon

What's most interesting about the sequential decline in almost every housing market metric is that this decline has been occurring in what should be the market's strongest seasonal period. If you are looking to sell your house and get the kind of prices that realtors are promoting, it is likely too late. If you want to sell your house, or have to, I would suggest getting it ready to be listed by mid-January and price it to sell, not to maximize profits.

Have a happy, healthy Thanksgiving and remember: enjoy what you can, as much as you can, while you still can.

Monday, November 25, 2013

Zimbabwe Ben, Janet "von Havenstein" Yellen And The Taper That Will Never Happen

[T]he Federal Reserve’s long and large scale purchases have significantly lowered long-term Treasury yields. - Ben Shalom Bernanke, Keynote Speech at the 2012 Jackson Hole Federal Reserve Conference LINKFor those of you who are unaware, Rudolph von Havenstein was head of the German Central Bank during the infamous Weimar hyperinflation/currency collapse period (1921 - 1923). As most of you know, every German who had their wealth denominated in German marks on the night of November 13, 1923 woke up the next day to discover that their paper wealth was worthless. Gold, for all intents and purposes, went to infinity as measured in the German mark (gold began the Weimar Republic period at 170 marks and peaked at 87 trillion marks).

I mention this as background because, despite the Fed's lip service to the contrary about reducing QE (the "taper"), the Fed has no choice to not only continue printing money, but will soon be forced to increase its rate of printing. Make no mistake, this is going to get crazy and they will probably eventually start buying assets other than Treasuries and mortgages, such as municipal bonds, pension liabilities and equities.

I wrote an article for Seeking Alpha that seems to be getting a lot of attention around the internet on this subject:

Since Bernanke first uttered the word "taper" in mid-May, the financial media circus cycle of "they'll taper this time around" has been repeating itself before every FOMC meeting and after the subsequent release of the FOMC meeting minutes. And yet, the Fed continues to defer reducing its QE policy after every meeting despite constant overtures to the contrary. The truth is that reducing the level of QE right now would likely cause a repeat of the 2008 near-collapse of the financial system, hurling the economy into a serious depression.You can read the entire piece here: Don't Fall For The Taper Talk - Again

The first indication that I may be on to something here is the price pattern of the U.S. dollar. Despite all the dollar bulls permeating the airwaves of financial media with their mindless drivel, this latest manipulated dead-cat bounce in the dollar appears to have run out steam pretty quickly:

(click on graph to enlarge)

As you can see from this chart, the USDX was unable to even bounce back up to its 200 day moving average in this latest dead-cat bounce. It appears ready to resume the nasty decline that began in July, after the Fed deferred tapering QE despite Zimbabwe Ben's threat to taper in May. In other words, the smart money (the Chinese, for instance) understands what's happening in this country and it (the smart money) is using every bounce in the dollar to dump (not just the Chinese, by the way).

For those who are unaware, Janet Yellen gave a policy speech in which she stated that negative interest rates may be necessary to stimulate employment. Just like Zimbabwe Ben's infamous "helicopter" speech in 2002, Yellen's speech offers insight into how she thinks about the implementation of monetary policy as a means of attempting to manipulate the economy. The USDX knows this. Most people who get their market news from CNBC or Bloomberg do not.

We are going to see higher rates that will kill the economy once and for all unless the Fed increases its bond buying program. The market is telling us that, not me. It's gotten so silly in terms of the perma-bull analysis - or what passes for analysis in this day and age - that I read an article over the weekend in which the money manager argued that higher interest rates would be bullish for the economy. Sorry pal, the only thing higher rates will signal is that the Fed is printing even more money in a desperate attempt to keep the bond and stock markets from collapsing. This may well drive the Dow higher, but please review the history of the Weimar Republic leading up to and including November 14, 1923 if you want to see how this ends. Here, I'll make it easy for you: LINK

What is even more frightening, especially given the degree of ramped up U.S. militarism, and the role played by the NSA in this, is to contemplate what happened in Germany after the Weimar Government collapsed...wouldn't it be diabolically ironic - in fact, tragically amusing - if Ben Shalom Bernanke and his successor, Janet Yellen, were the ones who ushered the U.S. into a similar type of Government that succeeded Germany's Weimar period...

Friday, November 22, 2013

China Is Getting Closer To Pulling The Plug On The Dollar

"...the reason for living was to get ready to stay dead for a long time" - Addie from, "As I Lay Dying by William FaulknerMany of you are aware by now that China has been methodically eradicating the use of the dollar in its bi-lateral trade with most of its largest trading partners. It has put in place large yuan-based currency swaps which are now used to settle trade with most of Asia and some large western hemisphere countries, including France and the UK. You are also aware of the enormous amount of gold that China has been importing and accumulating (LINK, for example). It's funny how research and investment analysts can find the data to prove this but somehow the World Gold Council and the GFMS seem to be unable to find it.

It looks like China is now getting ready to take the next step in "unplugging" the U.S. dollar as the world's reserve currency:

The People’s Bank of China said the country does not benefit any more from increases in its foreign-currency holdings, adding to signs policy makers will rein in dollar purchases that limit the yuan’s appreciation - LINK

I have been thinking for quite some time - dating back to 2003, to be exact - that China's end game, "check mate" move would be to eventually eliminate the dollar from its trade activities and roll out a new currency that would be backed by gold. At the same time China would implement a huge revaluation of gold in yuan terms in order to establish the necessary market value of its gold hoard to create an effective backing of the new currency. Now, of course, it won't happen exactly like this but in order to envision how a global currency reset will occur we need to think along those lines. However the mechanism is effected, the result will be a massive devaluation of the dollar. This is something that we all know is an inevitable event and that the natural forces of the market would eventually enforce, but something that the U.S. elitists have been deferring by means of insidious political and military-based coercion. And in order for it occur it will likely require that China tosses a straw on the camel's back in order to help the natural market forces override the U.S. repression of them.

There's really no way of determining a time-frame for the actual event so please don't ask me my view of when it will happen. What I will say is that we can observe certain "environmental" signals to let us know whether its sooner or later. Based on the blatant and extreme corruption exhibited by our political and business leaders and based on what I sense is desperation and unrest being reflected by a growing number of dissatisfied middle class people ("middle class" here is defined as anyone who does not have enough liquid wealth to buy their own politician, so 99.9% of us), I suspect that "the event" is a lot closer than most us can possibly discern.

And it looks like the U.S. dollar and the American way of life is getting ready to stay dead for a long time.

Thursday, November 21, 2013

An Insightful Description Of What Is Occurring On Main Street

As I have been saying would happen, the housing market bounce of the last 18 months is starting to crack. This is a crack that I expect will widen into a big canyon, into which home sales and prices will fall. It will be a resumption of the bear market trend in the housing market that began in mid-2005 and which needs to go a lot lower and exact a lot more pain before the excesses of the Greenspan/Bernanke/Bush/Obama era have even a chance of being cleansed and fixed.

Existing home sales for October were released yesterday. And while the year over year headline result was announced as being a big positive, it turns out that if you dig into the actual month-to-month numbers the housing market is slowing down - quickly. You can read my analysis of the numbers and the overall housing market here: October Existing Home Sales

Meanwhile, as the stock market plows inexorably toward the moon and then, with a lot more QE, onto Pluto, I was discussing with a friend how QE has done nothing for the economy other than help out a few homebuilders, realtors and most of the corporate insiders who are unloading their company shares at a record pace. In the context of chatting about the rampant systemic Government and corporate corruption, we discussed how small businesses and individuals have been left in the satanic dust created by the Government and Wall Street. His commentary on this was too priceless not to share:

Existing home sales for October were released yesterday. And while the year over year headline result was announced as being a big positive, it turns out that if you dig into the actual month-to-month numbers the housing market is slowing down - quickly. You can read my analysis of the numbers and the overall housing market here: October Existing Home Sales

Meanwhile, as the stock market plows inexorably toward the moon and then, with a lot more QE, onto Pluto, I was discussing with a friend how QE has done nothing for the economy other than help out a few homebuilders, realtors and most of the corporate insiders who are unloading their company shares at a record pace. In the context of chatting about the rampant systemic Government and corporate corruption, we discussed how small businesses and individuals have been left in the satanic dust created by the Government and Wall Street. His commentary on this was too priceless not to share:

It's a horror show. I know 2 guys in their 50's and 60's who are close to running out of money. For younger people, generally blue collar guys are the only ones who'll talk openly and freely about reality, and they're angry. The white collar set is brainwashed into pretending that they're keeping up with the Joneses, too stupid to question if their neighbors are living an illusion propped up on credit cards. I freely tell whitey to stop watching TV or it'll finish the chemical conversion of their brains into cat food.