If you read between the lines of Bernanke's headline comments, he essentially is saying that he's ready to print a lot of money if "necessary." That's why the metals where ambushed hard yesterday, it's why the dollar dropped like a rock on no other news overnight, it's why they took the metals down as the headlines hit and it's why the metals spiked hard after the initial hit today. We actually removed all hedges from our fund yesterday after the ambush because I suspected this would be the case.

This is highly orchestrated at this point and frighteningly Orwellian. The metals are getting ready for a big move higher and all of the short-term trading geeks/computer funds using rsi's and macd's are going to get hammered on shorts or miss out on a very big run if they are flat.

Bernanke's speech was exactly what I thought it would be in terms of FOMC policy promotion: basically a regurgitation of the last FOMC meeting statement. You don't need to dissect his statements word for word the way that bald idiot on CNBC (Steve Liesman) likes to do. If you look at what he says contextually, it's easy to see that he's ready to drop a massive printed money into the system once the election is over. I don't think its coincidental that the Treasury debt ceiling will be hit about a month AFTER the election. Remember: the purposes of money printing are 1) to keep the banks solvent/liquid and 2) to finance Treasury debt. Per the latter, we know that during one trailing 12 month period after QE2 was announced, the Fed indirectly bought 90% of all new Treasury debt issued. For all of 2011, the Fed bought something like 60% of all Treasury debt issued.

That's why I can't understand why newsletter "experts" like The King Report and Phoenix Capital, the latter featured on Zerohedge, are so adamant about their view that there will not be any more QE. If that's the case, how will the Government fund its operations? It's really that simple. It's not about the economy, stupid.

The bottom line is that today's move in the metals took a lot of people by surprise. In addition, the open interest in silver has declined quite a bit this week in what is likely aggressive short-covering by JP Morgan. In other words, something is going on behind "the curtain" which we are not seeing that has triggered short covering by "insiders" to the market. Next week should be interesting, to say the least.

I hope everyone has fun holiday weekend. The tennis U.S. Open will be in full swing this weekend - hopefully Andy Roddick lasts a few more rounds before he retires and college football kicks into full gear, as does the Friday night lights of high school football.

Friday, August 31, 2012

Thursday, August 30, 2012

Ring The Bell: Treasury Debt Now Over $16 Trillion - A Modest Proposal

Behind every small business, there’s a story worth knowing. All the corner shops in our towns and cities, the restaurants, cleaners, gyms, hair salons, hardware stores – these didn’t come out of nowhere. A lot of heart goes into each one. And if small businesspeople say they made it on their own, all they are saying is that nobody else worked seven days a week in their place. Nobody showed up in their place to open the door at five in the morning. Nobody did their thinking, and worrying, and sweating for them. After all that work, and in a bad economy, it sure doesn’t help to hear from their president that government gets the credit. What they deserve to hear is the truth: Yes, you did build that. - Paul Ryan, Republican VP Candidate, RNC SpeechI just want to preface that my using that passage from Ryan's speech last night in no way is an endorsement of the Romney/Ryan ticket for the Presidency. In fact, as I've stated on this blog previously, I firmly believe the best way to get real change in this country is if no one shows up to vote on election day, which would de facto invalidate our Government.

People accuse me of being unpatriotic and ungrateful for not voting. But, au contraire, I would argue that anyone who does vote is affirming and legitimizing an illegitimate system. Our Governmental system bears no resemblance to the system ratified and put in place by the Constitution and our "elected" officials - nearly every one of them - is either a complete fraud (Obama) or thoroughly corrupt.

Moving along, I wanted to point out that as of Tuesday's debt issuance by the Government, our national Treasury debt officially exceeds $16 trillion. The debt ceiling limit put in place in 2010 is $16.394 trillion. It was lifted to this level at the end of January 2012. At this rate of new debt issuance, roughly $114 billion per month, the Government will exceed its legal debt limit by the beginning of December. And please keep in mind that there is off-balance-sheet Government guaranteed debt in the form of Fannie Mae, Freddie Mac, FHA and General Motors. That extra $8-10 trillion gets conveniently left out of everyone's discussion. But not mine.

Furthermore, a report was released earlier this week showing that the 50 individual States collectively have over $4 trillion in outstanding bonds, unfunded pension commitments and budget gaps: LINK If you add that to the debt that is an obligation of the U.S. Treasury (vs. all the "legacy" liabilities like under-funded Federal pensions, social security, medicare, etc), you have around $30 Trillion in Federal and State direct debt. That's about 200% of GDP. That ratio makes Greece and Spain look like "gold standard" countries.

When will this debt/dollar bubble finally burst? Anyone's guess is as good as mine, but mathematically this can not go on much longer. Either the Government has to shut everything down except the functions provided in the Constitution or the Fed has to crank up the printing press in a major way. I will say that anyone who owns Treasury bonds, from the Chinese Central Bank to the lowliest American retiree, is a complete idiot. I'd rather own a big bag of shit. At least I can sell the bag of shit for use as crop fertilizer.

Circling back to my endorsement of that particular passage from Ryan's speech last night (honestly, that was actually the only part I heard as I had clicked on to CNN randomly and there it was. It was also the first time I've heard Ryan give a speech - his voice makes him sound like a high-pitched pin-head - it's bad enough that he looks like Pee Wee Herman), it was clearly a massive missile fired at Obama's comment that American business owners owe their success to the Government. I don't think anything I've heard Obama say has pissed me off more than that. Obama owes his "success" to the Government and to all the socialist programs put in place like Affirmative Action which have enabled Obama throughout his life.

Obama has been a lifelong beneficiary of public spending and the public payroll. In fact, Obama has made more than enough money off of his book deals to live comfortably and I have this modest proposal: Obama should be the first person on Capitol Hill who gives up his Taxpayer and debt-financed salary plus benefits in order to help solve our catastrophic debt problem . And he should step forward as a leader and call on all members of Congress who have personal wealth to give up their Congressional pay and benefits. I think as public servants this is the least they all can do.

Tuesday, August 28, 2012

The U.S. Is In Much Worse Shape Than Europe

The United States should be ashamed. While many experts criticize the Europeans for not pulling together politically, U.S. indebtedness is far greater and more dangerous to the world economy. - Jack Mintz, Palmer chair, School of Public Policy, University of Calgary (article link below)This will be a bit of a rant day for me. The markets and the news flow has down-shifted to low-gear ahead of the Labor Day Weekend. I was playing tennis with friend this past weekend who is a long-time financial "adviser" for Lincoln Financial. Of course before we started he wanted to discuss how everything was looking good for the economy and the markets. I was like, "huh, what data are you looking at?" He pointed to the S&P 500 earnings. I quickly shot that down by explaining that if you used 1980 GAAP accounting standards on today's earnings, the S&P 500 earnings would be at least cut in half, especially now that financials represent about 15% of the S&P 500 index my market cap weight and we know all the fraudulent accounting games being played by the big banks and insurance companies to generate earnings. That deflated him a bit. Then I pointed out several other factoids about our system of which he is aware but - like most everyone else - chooses to ignore. The bottom line is that 99% of all financial advisers get paid well to sell fairy tales and most Americans with any kind of investment portfolio left after 2008 have been set up for a complete wipe-out once the focus on the problems in Europe shift to the bigger problems in this country.

I've been making the argument for at least a year now that the United States is in much worse shape financially and structurally than is Europe. The highly visible insolvency problems of several EU-member countries are being used as a "deflection" device by Wall Street and politicians to help cover-up the much larger insolvency problem in this country.

To be sure, if any one of the countries in the EU on the verge of collapse actually collapses, it will trigger widespread financial destruction globally - although primarily in the U.S., Europe and the U.K. But this is because of the well-hidden, off-balance-sheet OTC derivatives exposure of the Too Big To Fail U.S. banks and their Anglo-European counterparts (primarily JP Morgan, Citibank, Morgan Stanley, Goldman, Bank of America, Deutsche Bank, HSBC, Barclays, Soc Gen). In fact, I've maintained all along that the primary goal of QE/LTRO (Fed/ECB/BOE) has been to keep the big banks, and their parent Central Banks, from collapsing. Secondarily the purpose of this money printing has been to create the funding which finances the respective Governments. The "save the economy and create jobs" mantra - pimped especially hard in the U.S. - is nothing more than a smoke-screen grabbed on to by the politicians for political expedience.

What amazes the most is the way that much bigger leverage/insolvency issues in the United States get swept under the rug while everyone points a finger at Greece, Spain or Italy. But for those who bother to dig under the surface, both California and Illinois present equally as catastrophic fiscal conditions as their EU counterparts. In fact, California measured as an individual financial/economic "system" is bigger than Greece, Italy and Spain combined. While the Fed creates credit availability to keep big European banks solvent, the Federal Government in this country (i.e. all the Taxpayers collectively) quietly provides funding to keep the States of California and Illinois from collapsing.

If you look at the United States' finanical situation on a macro level:

[Larry] Kotlikoff’s calculations show that U.S. unfunded liabilities total US$222-trillion, the highest of all major OECD countries (12% of the time value of U.S. GDP) once accounting for monetary public debt, Social Security deficits and public-health-care unfunded liabilities. One can quibble with some of the calculations, but no one can doubt that the U.S. is in serious fiscal trouble, more so than any other developed economy.The reference is to Boston University's Larry Kotlikoff, here's the article LINK As the article goes on to explain, the U.S. - and really the whole world - has been operating under a catastrophic Ponzi scheme system, in which debt is used to pay off debt, and now money is printed up by Central Banks to pay off maturing debt and create even more new debt. It's going on all over the developed world, but its at its most extreme in the United States. And Kotlikoff's numbers only reflect the insolvency of the U.S. Government. That problem is more than doubled if you include the underfunding of State and private pension plans plus the massive real estate and credit card/student loan debt in this country.

What the article fails to address is that the seeds of our Ponzi-fueled destruction were sewn by the Bretton Woods Agreement and the shift from a global economic system based on the gold standard to one based on "faith." Now, you can argue all you want about the validity of faith-based religion, and none of us will ever live long enough to know if "One" exists or not. But we know for a fact that throughout the last 5,000 years of history faith-based currency systems end in catastrophic failure and world war.

And in the U.S., all the signals that our fiat, faith-based Governmental system - which rests on a nothing but a "full faith and credit" currency system - is in the latter stages of a catastrophic collapse: widespread corruption by business and political leaders, full enabling of this corruption by the Government, imperialism, extreme economic decay (see Detroit, Cleveland, et al), totalitarian "creep," and the extreme devaluation of the currency. Wash, rinse, repeat: "Those who cannot remember the past are condemned to repeat it" - George Santayana, Spanish philosopher.

The golden truth is that once the election is over in the U.S., I fully expect that the global infatuation with the daily vicissitudes in Europe will shift to the catastrophic debt bubble in the U.S. Especially since I fully expect that Congress will loosen up the laws and kick the "fiscal cliff" down the road some more. And this will be fully financed by the Fed with "open-ended" QE in the form of large-scale mortgage and Treasury bond purchases. At that point I expect that our Asian financiers (China, Japan) will come realize that, while Europe is at least having conversations and making an attempt at solving its financial predicament, the U.S. is whistling in the dark as it heads down the path of collapse.

You need to move a large portion of your investment wealth into physical gold and silver, or you will be swept under the tide of George Santayana's prescient warning...

Friday, August 24, 2012

Fun With Numbers Friday

I would just like to add that we see shares of Apple hitting new all-time highs, even though their last quarter wasn’t quite up to snuff. But the market cap of Apple is now greater than three times that of all of the world’s publicly traded gold and silver equities...This will be seen as preposterous in the fullness of time, and I can assure that this will reverse as the bull market in gold and silver mature. - John Embry, King World News LINK

I felt compelled to comment on the new home sales number for July number reported yesterday because the headline was egregiously misleading. The headline triumphantly reported 372,000 annualized homes were sold in July. Note this is a seasonally "adjusted" number which is then annualized. A supposed 14% increase over the June number.

However, if you pull up the actual news release from the Department of Commerce, which of course I did and CNBC or your local newspaper did not, you'll see that there were 34,000 actual homes sold in July, the same number as in June. Even more ominous, the median price of a new home dropped to $224k in July from $229k in June. The average price dropped from $266k to $263k. One would think that, IF the market were as strong as the media and industry cheerleaders would have us believe , the average price of a new home should stay the same or at least stay constant. I smell the desperation of discounting...Here's the new home sales report if anyone wants to peruse the data: LINK

One more point on this, essentially the adjusted number assumes the maintainability over time of the July actual number. But this is the peak selling season. If I'm right about the economy - and I have zero doubt that I'm not, we'll see the actual number of new homes being sold over the next six months likely drop in half. That would take you 372k adjusted annualized number down below 200k. Not good...

What's troubling about the recent housing statistics, especially the long string of weekly declines in mortgage purchase applications, is that with record low mortgage rates and a supposedly recovering economy we should see housing staging a real and meaningful recovery. But as Mark Hanson details in his most recent blog post, the massive Fed/Govt stimulus into the housing market has done nothing except "pull forward" a substantial number of home purchases, leaving the system with a lot of "shadow inventory" overhang and a depleted pool of potential buyers: LINK

And even more troubling, a large source of housing market stimulus has come from YOU, the taxpayer. The FHA share of mortgage financing has gone from just 7% of the market in 2007 to as high as 30% of all mortgages issued. To make matters worse - aside from the fact that FHA mortgages incorporate taxpayer subsidized expense reduction features - this expansive pool of new FHA mortgages now sports a 16% delinquency rate. That's 1 in 6. In other words, FHA taxpayer mortgages are the new subprime financing product - the new Countrywide/Wash Mutual of our housing market. And we saw how well that ended...here's a great article on that subject: LINK

Today the Govt released its durable goods orders number for July. The headline that 99% of the people in this country who are paying attention will see is that durable goods jumped a torrid 4.2% and far exceeded the expected number. However, if you strip out a large one-time order by Boeing - which is always subject to cancellation or partial cancellation - durables were actually down .4% and missed expectations. If look at non-defense capital orders ex-aircraft parts, "core" durables plunged over 3%. Not good. Ugly, in fact. Here's the report: LINK

Finally, for all you Facebook faithful, you should be aware that a Facebook director and the first outside investor dumped almost all of his stake as soon as he was able to as set by the terms of the IPO underwriting agreement. As Bloomberg reports, it is highly unusual for an IPO insider to get rid of their shares this quickly after an IPO: “It’s a bit stunning that at the earliest opportunity it was sold and the volume that was sold,” said Hamadeh. “Their job is to liquidate, but typically it’s a little more gradual.” If you still own Facebook, you should be digging into why this guy felt compelled to unload this quickly and so far below the IPO price. You are an idiot if you call your broker accept the standard explanation that "he was diversifying his investments."

Oh, one more thing. Many of you are aware that Meredith Whitney took a lot of heat about 18 months ago for prognosticating widespread municipal bankruptcies. Her view is quite the same as mine, only she had the benefit - or dis-benefit - of widespread public exposure and ridicule. It looks like her call will be correct, just early. Just in the past few months we've seen three of the largest municipal bankruptcies ever. If you are one who believes that elitists have a better view than the rest at what is going on behind the scenes, and you have a big portfolio of "high yielding" muni bonds, you might want to pay attention to this: LINK (copy the headline and paste it into a google search browser and you'll get the whole article). Warren Buffet, who definitely gets a better look "behind the curtain" than most of us, has terminated over $8 billion municipal default insurance that was underwritten by Berkshire. Not a good sign...Have a great weekend.

I felt compelled to comment on the new home sales number for July number reported yesterday because the headline was egregiously misleading. The headline triumphantly reported 372,000 annualized homes were sold in July. Note this is a seasonally "adjusted" number which is then annualized. A supposed 14% increase over the June number.

However, if you pull up the actual news release from the Department of Commerce, which of course I did and CNBC or your local newspaper did not, you'll see that there were 34,000 actual homes sold in July, the same number as in June. Even more ominous, the median price of a new home dropped to $224k in July from $229k in June. The average price dropped from $266k to $263k. One would think that, IF the market were as strong as the media and industry cheerleaders would have us believe , the average price of a new home should stay the same or at least stay constant. I smell the desperation of discounting...Here's the new home sales report if anyone wants to peruse the data: LINK

One more point on this, essentially the adjusted number assumes the maintainability over time of the July actual number. But this is the peak selling season. If I'm right about the economy - and I have zero doubt that I'm not, we'll see the actual number of new homes being sold over the next six months likely drop in half. That would take you 372k adjusted annualized number down below 200k. Not good...

What's troubling about the recent housing statistics, especially the long string of weekly declines in mortgage purchase applications, is that with record low mortgage rates and a supposedly recovering economy we should see housing staging a real and meaningful recovery. But as Mark Hanson details in his most recent blog post, the massive Fed/Govt stimulus into the housing market has done nothing except "pull forward" a substantial number of home purchases, leaving the system with a lot of "shadow inventory" overhang and a depleted pool of potential buyers: LINK

And even more troubling, a large source of housing market stimulus has come from YOU, the taxpayer. The FHA share of mortgage financing has gone from just 7% of the market in 2007 to as high as 30% of all mortgages issued. To make matters worse - aside from the fact that FHA mortgages incorporate taxpayer subsidized expense reduction features - this expansive pool of new FHA mortgages now sports a 16% delinquency rate. That's 1 in 6. In other words, FHA taxpayer mortgages are the new subprime financing product - the new Countrywide/Wash Mutual of our housing market. And we saw how well that ended...here's a great article on that subject: LINK

Today the Govt released its durable goods orders number for July. The headline that 99% of the people in this country who are paying attention will see is that durable goods jumped a torrid 4.2% and far exceeded the expected number. However, if you strip out a large one-time order by Boeing - which is always subject to cancellation or partial cancellation - durables were actually down .4% and missed expectations. If look at non-defense capital orders ex-aircraft parts, "core" durables plunged over 3%. Not good. Ugly, in fact. Here's the report: LINK

Finally, for all you Facebook faithful, you should be aware that a Facebook director and the first outside investor dumped almost all of his stake as soon as he was able to as set by the terms of the IPO underwriting agreement. As Bloomberg reports, it is highly unusual for an IPO insider to get rid of their shares this quickly after an IPO: “It’s a bit stunning that at the earliest opportunity it was sold and the volume that was sold,” said Hamadeh. “Their job is to liquidate, but typically it’s a little more gradual.” If you still own Facebook, you should be digging into why this guy felt compelled to unload this quickly and so far below the IPO price. You are an idiot if you call your broker accept the standard explanation that "he was diversifying his investments."

Oh, one more thing. Many of you are aware that Meredith Whitney took a lot of heat about 18 months ago for prognosticating widespread municipal bankruptcies. Her view is quite the same as mine, only she had the benefit - or dis-benefit - of widespread public exposure and ridicule. It looks like her call will be correct, just early. Just in the past few months we've seen three of the largest municipal bankruptcies ever. If you are one who believes that elitists have a better view than the rest at what is going on behind the scenes, and you have a big portfolio of "high yielding" muni bonds, you might want to pay attention to this: LINK (copy the headline and paste it into a google search browser and you'll get the whole article). Warren Buffet, who definitely gets a better look "behind the curtain" than most of us, has terminated over $8 billion municipal default insurance that was underwritten by Berkshire. Not a good sign...Have a great weekend.

Thursday, August 23, 2012

Follow-up To Yesterday

“Whether it be gold shares on their own, compared to gold, versus bonds or versus the stock market, gold shares are rising from the dead.” - Aden Sisters, sourced from Peter Brimelow's Marketwatch column (link below).Gold is up about another $30 from when I published yesterday's post. I never assume that we'll get a move like that in 24 hours, but I know that we have days ahead of us in which gold will move $100 or more. Gold is up nearly $150 in just over the last 62 hours.

Yesterday I posted a 3-yr weekly chart. I thought it might be interesting to look at an even "bigger" picture of gold. Here's a 10-yr, monthly chart of the Comex gold:

There's really not a lot that can be said beyond what is being conveyed by the chart itself. Leonardo Da Vinci could not have created a more perfect diagram of a bull market. We've had three nasty bull market price corrections during this 11-yr bull. I've highlighted them with the red circles. Each one is characterized by a quick fall from a cyclical price peak, followed by a period of consolidation, followed by another extended move to a new high. I excpect this time around to be no different.

Again, notice the positioning of the MACD signal. Given that this is being measured on a monthly time frame basis, it will take a long, extended move higher to produce an over-bought MACD reading. In other words, every other wildly bullish indication is being confirmed by this indicator.

I was mentioned this morning in Peter Brimelow's Marketwatch column - Brimelow is probably the most experienced and knowledgeable of the mainstream gold market reporters/writers: "'The Golden Truth website, reportedly written by a gold-market professional, says on Wednesday after a detailed chart discussion: “From both a fundamental and technical standpoint, the indicators for gold to make a run to new highs have not been this bullish in the 11-year bull market.'" Here's his report from today: LINK Brimelow has a lot of connections in the market not available to most writers and it's worth checking Marketwatch for his reports.

I'll end with one thought for you ponder: The gold (and silver) bull market has had an impressive 11-yr run, given the incredible amount of resources that the western Central Banks and media spin-machines has thrown at gold in an attempt to suppress the price and discredit gold's importance to any financial system - just imagine how powerful and violent the move will be once the Fed/ECB/BOE lose all ability to control the price...

Wednesday, August 22, 2012

Gold (and silver) Is Getting Ready For Big Move

The bottom line here is that these large, well-financed entities are now anticipating inflation for the foreseeable future. This means the ‘risk on’ trade is back in vogue, and we should see higher prices for gold and silver going forward. I would also add that there is a great deal of money on the sidelines and this means we will see some violent action as these markets move to the upside - Dan Norcini from King World News LINKThe price of gold has been in a massive consolidation phase for about a year. With or without help from another round of QE, the world's oldest currency is "coiling" for another cyclical gold bull market move higher. Here is a weekly 3-yr chart of gold with RSI and MACD "momentum indicators:

(click on chart to enlarge)

I've circled the RSI and MACD indicators in green. I like using a weekly chart to analyze longer term trends. Using a weekly time frame amplifies the significance of trading indicator signals, which makes the fact that both the RSI and MACD are turning up from inordinately oversold levels even more bullish. The price-action on this chart shows the massive line of support that has formed just below $1600. Fundamentally this makes sense given the numerous accounts of large-scale Central Bank buying whenever the Comex manipulators have tried to take gold below $1600 during the past 6 months.

This next chart shows the rolling 12-month "rolling" rate of return on gold in terms of its standard deviation from its mean (average) 12-month "rolling" rate of return. Without having to bend your mind around what that exactly means, think of it as the amount by which the most current 12-month trailing rate of return is either above or below it's average rate of return for the period:

(click on chart to enlarge)

This chart, which I sourced from HERE shows that each time that the calculated metric goes 2 standard deviations (green circles) below its mean, it represents an incredibly powerful buy-signal. Again, you can look at a chart for comparison purposes, but in the previous two instances where this occurred, gold began a move up to new all-time nominal highs (as opposed to inflation-adjusted since 1980). Given the fundamentals we all know about, I see no reason why that won't occur this time.

Here's another aspect that hasn't been a factor at all during the 11-yr gold bull: PRICE INFLATION

As you might expect, I have a chart that shows the potential for some serious price inflation to kick in. This is from Dan Norcini's KWN interview linked above:

(click on chart to enlarge)

In Dan's words: "Take a look at my Grain Composite Index - if you thought grain prices were high back at the peak of the commodity bubble in 2008, you haven’t seen anything yet! The Index is now firmly above 2008 high."

Interestingly, I have not seen it discussed, but gold has done what it's done over the past 11 years without any real fear of price inflation. Obviously money supply inflation/dollar devaluation has been the key driver. But big institutional investors and retail investors measure "inflation" mostly using the Government's CPI index. At some point the fundamentals underlying the chart above plus the rampant historical and impending money supply explosion will trigger massive price inflation. That's when the action in gold will get really interesting.

Finally, based on the large spec/commercial long/short positioning on the Comex, per the weekly COT reports, technically gold is set-up for another massive inflow of hedge fund money. I think there's a good chance we'll see this in the next few months, especially once the Fed caves in on more QE - which it will.

From both a fundamental and technical standpoint, the indicators for gold to make a run to new highs have not been this bullish in the 11-year bull market. Since we've been missing widespread big institutional and retail participation, if those two investing constituencies get involved, the coming move higher in gold may take all of us by surprise.

Monday, August 20, 2012

Boom Goes The Dynamite: Silver Pops

But gold has risen with only slightly more than 1% of the world’s assets in gold. Right now the world’s assets are about $150 trillion. Of that number, $60 trillion is in cash, $40 trillion is in bonds, and $40 trillion is in stocks. But, remarkably, only $2 trillion or just a bit over 1% is in gold.

With inflation headed higher, institutions, which have virtually no allocation to gold today, they will have to increase their allocation to gold. There have been several studies over the last few months that have suggested that institutions will need to put part of their funds in gold.

If you look at world financial assets, a 1% increase in allocation to gold of the world’s financial assets would require 12 years of gold production at today’s prices. There simply isn’t the gold available at today’s prices to facilitate even a small move by institutional money into the sector. Of course they can never get a sizable commitment into gold at these prices.

I would also add that over time they will put a lot more than 1% into gold. The studies I reference also suggest that institutions will improve their risk vs return situation by moving money into gold. So I am convinced that there will be a big inflow of institutional money into gold over the next two or three years

- Egon Von Greyerz on King World News

After almost 9 weeks of trying to break over $28, silver closed over over $28 on Thurs/Friday and, after a concerted and blatant attempt by the silver manipulating banks to take silver below $28 this morning, it inexplicably shot up like a roman candle at 9:12 a.m. Denver time. I say "inexplicably" because I could not find any specific news which might have triggered the move, the SPX did not move at all (so the move in silver was not in correlation with the stock market) and gold moved higher higher as well although not anything that closely correlates with the scale of silver's move.

As subscribers to GATA's Le Metropolecafe know, one of Bill Murphy's sources in Switzerland - someone who is described as being in a position to know - has told Bill that JP Morgan is in trouble with its short position in silver. Please note, that we only see JP Morgan's massive, illegal but unpoliced short position on the NY Comex market. We have no idea what its short position on the LBMA or in OTC silver derivatives looks like (although we do know that JP Morgan has by far the largest position in OTC "metals" derivatives per the quarterly BIS report).

Beyond that we do not know much other than JP Morgan has been the big manipulator in the silver market for many years and likely does so on behalf of the Federal Reserve/U.S. Government. We also know that at some point in the future that JPM's paper short position in silver is potentially the equivalent of a small nuclear device embedded deeply the bank's bowels. The trigger will be the point at which counterparties to JPM's short position demand physical delivery of the silver JPM is derivatively short on the Comex, LBMA and OTC derivatives market.

On this note, given that JPM is the custodian for the massive SLV ETF, which means JPM is the gatekeeper on the enormous stockpile that SLV is supposed to have stored in JPM-controlled vaults, I would not advise anyone to own SLV. SLV, like GLD, has the potential to be another Enron. Just for the record, JP Morgan was one of Enron's primary advisory banks.

Friday, August 17, 2012

Friday Chart Porn

General experience suggests that the economy has not recovered. As shown in Commentary No. 459, the official recovery simply is a statistical illusion created by the government’s use of understated inflation in deflating the GDP, which overstates deflated economic growth...The long-term fiscal solvency issues of the United States - where GAAP-based accounting shows annual deficits running in the $5 trillion range—are not being addressed, and the politicians currently running the government lack the political will to address those issues. - John Williams, Shadow StatisticsMany of us who have been researching, investing and trading the precious metals bull market for the past 11 years are of the consensus view - for what any consensus view is worth - that the precious metals are getting ready to start on the next leg of the bull market. There are several factors which underlie this mindset, not the least of which is the acceleration in non-U.S./Western Central Bank accumulation of physical gold.

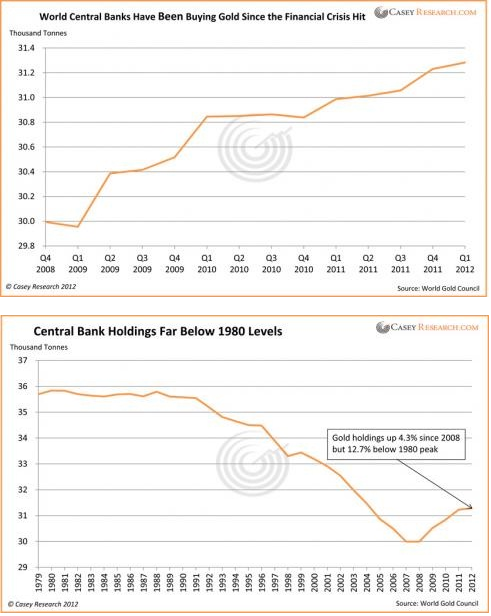

As an example, through the end of May, China had imported 315 tonnes of gold via Hong Kong. This is a staggering amount of gold considering that global gold mining production is around 2600 tonnes annually. It is suspected by the those who closely study the data that most of that gold is being accumulated by China's Central Bank. Here are two graphs which show the trend in Central Bank gold accumulation (source: Casey Research/World Gold Council):

As you can see, global Central Bank gold holdings are well below the 1980 levels. Imagine the price effect if there is a rush by Central Banks to raise their gold holdings to at least 1980 levels in the face of ongoing paper currency devaluation.

And here is what the proverbial smart money is doing:

I guess some of us would find it ironic that the "do as I say, not as I do" mentality of Soros is that same mentality of Obama, who is one of Soros' political sock-puppets. Somehow I doubt Obama is smart enough to own any gold, other than the bling that adorns his "let them eat cake" wife.

Thursday, August 16, 2012

Uncle Tom's Justice Department

Take heed Obama supporters (of course, it was no different under Bush II and would be no different under Romney), but your beloved Hope and Change President is overseeing the greatest wave of fraud, corruption and wealth confiscation in the history our country.

Anyone who really cares to understand the extent to which Obama's Justice Department is enabling the process of systemic corruption and collapse should read this scathing article by Matt Taibi: LINK

Anyone who still defends Obama must read that - otherwise you have no business even voting. Lew Rockwell wrote a brief editorial in which he correctly argues that the best choice for Americans is to not vote. I made this argument in 2008 and was derided by all the supposed "patriots." Now I have several friends/colleagues who understand that not voting is better than voting:

Until the population of this country forces a "reset," we have collapsed into a country in which Rule of Law has become Rule by Men and Habeas Corpus has become Mortuus Corpus.

Anyone who really cares to understand the extent to which Obama's Justice Department is enabling the process of systemic corruption and collapse should read this scathing article by Matt Taibi: LINK

Anyone who still defends Obama must read that - otherwise you have no business even voting. Lew Rockwell wrote a brief editorial in which he correctly argues that the best choice for Americans is to not vote. I made this argument in 2008 and was derided by all the supposed "patriots." Now I have several friends/colleagues who understand that not voting is better than voting:

On the other hand, we do have the freedom not to vote. No one has yet drafted us into the voting booth. I suggest that we exercise this right not to participate. It is one of the few rights we have left. Nonparticipation sends a message that we no longer believe in the racket they have cooked up for us, and we want no part of it...This year especially there is no lesser of two evils. There is socialism or fascism. The true American spirit should guide every voter to have no part of either.Here's the LINK

Until the population of this country forces a "reset," we have collapsed into a country in which Rule of Law has become Rule by Men and Habeas Corpus has become Mortuus Corpus.

Wednesday, August 15, 2012

Update On Housing And Government Economic Statistics

I take great pleasure when I post a view on an economic topic and then subsequently I find even more empirical evidence that my view is correct. After I published my updated thoughts on the housing market in this country - which of course runs contrary to the noise coming from the media and the bubblevision idiots - I found an article on housing which was actually written a day before my post on Monday.

I have been following the Dr. Housing Bubble blog for several years and the author posted a blog piece detailing the incredible rise in low-down-payment FHA insured mortgages since 2007. I have been harping on this point for quite some time now, and this piece presents the hard data. The FHA - aka the Taxpayer - is sponsoring 3.5% down payment mortgages, which have more than doubled in terms of the number of loans outstanding from 3 million in Q2-2007 to 6.8 million in Q2-2012.

Unfortunately, the performance characteristics - i.e. rate of delinquency/defaults - of FHA mortgages is starting to make them look like nothing more than taxpayer-sponsored subprime mortgages. How do you all like that? Here's the blog post, which I would urge everyone to spend time reading: LINK What I find ironically humorous is that the housing market cheerleaders are actually cheering us into the next big housing mortgage blow-up. It's kind of like the chickens in the barnyard cheering for the success of Colonel Sanders...

On to the Obama Government. As everyone who watches any television knows, Obama is taking full credit for a supposed saving and turnaround of General Motors. Given the enormous taxpayer resources that have been shifted from the taxpayers to the bank accounts of GM upper management and union workers, any claim of success from an economic standpoint is highly questionable, if not outright a lie. In stark contrast to Obama's boastful bullshit - something which has become one of his hallmark traits - it turns out the U.S. Treasury just released a new estimate of the cost of the bailout to Taxpayers. Originally Geithner was claiming $21 billion. He's now upped the ante to $25 billion: LINK. Please note: this is just an estimate, which has been no doubt highly polished and massaged to cover up the true cost.

HOWEVER, the Treasury estimate would not include the big loss the Government/Taxpayer has in GM's stock. The Govt still owns about 30% of the outstanding shares, the value of which has declined $6.1 billion since the GM IPO. Add that to the $25 billion cost estimate and we're now north of $31 billion. This assumes GM stock does not decline anymore before the Government unloads the rest of its stock. GM stock is down 39% since its November 2010 IPO. The Dow is up 18% in that time frame. Imagine what happens to GM stock if the Dow goes back into bear market mode, which it will in spades if the Fed does not print up a lot more money. If these numbers are considered "success" by Obama, I truly fear what a failure looks like...

Last, I wanted to delve briefly into yesterday's July retail sales report released by the Obama Government. It reported that retail sales were up .8% for July from June, which was a lot higher than the .3% Wall St. estimate. This number is highly questionable, and most likely substantially wrong. First, understand that this number is computed using questionable sampling methods which involve contacting selected retailers and having them "guesstimate" what their sales will be for July based on early month trends: Advance estimates are based on early reports obtained from a small sample of firms selected from the larger Monthly Retail Trade Survey (MRTS) sample. All other estimates are from the MRTS sample.

This description of the data sampling comes from the Census Bureau's report: LINK If you pull up that link, you'll see that the footnotes also describe the "adjustment" process the Government applies to the data to "seasonally adjust" the numbers. Translation: "we take questionable advance sales estimates and put them through our turkey grinder and adjust the results to fit our political needs." Furthermore, they "revised" lower the number from June, which mathematically makes the "calculated" increase for July look even greater.

In addition, the data released by the Government is not in any way supported by the actual sales tax receipts for July from California, the largest State in the country with 12% of the population and the 8th largest economy in the world. As you can see from this LINK, California's sales tax receipts were down 40% from July 2011 and were 33.5% below the estimated expectation. So you can see just how accurate "advance estimates" can turn out in reality. Quite frankly, a data sampling representing 12% of the U.S. population is likely a lot more accurate than the Government's loose advance estimate sampling.

Finally, a report released which contains Mastercard's retail sales data for small retailers for July showed that retail sales at small retailers plunged from July last year (consistent with the California data), but also dropped off month to month from June, quite contrary to the Government's claim: LINK.

So do you want to place faith in actual cash-register data from the State of California and from Mastercard, or place your faith in the Government? The truth is that the Government retail sales report is outright fraudulent.

I have been following the Dr. Housing Bubble blog for several years and the author posted a blog piece detailing the incredible rise in low-down-payment FHA insured mortgages since 2007. I have been harping on this point for quite some time now, and this piece presents the hard data. The FHA - aka the Taxpayer - is sponsoring 3.5% down payment mortgages, which have more than doubled in terms of the number of loans outstanding from 3 million in Q2-2007 to 6.8 million in Q2-2012.

Unfortunately, the performance characteristics - i.e. rate of delinquency/defaults - of FHA mortgages is starting to make them look like nothing more than taxpayer-sponsored subprime mortgages. How do you all like that? Here's the blog post, which I would urge everyone to spend time reading: LINK What I find ironically humorous is that the housing market cheerleaders are actually cheering us into the next big housing mortgage blow-up. It's kind of like the chickens in the barnyard cheering for the success of Colonel Sanders...

On to the Obama Government. As everyone who watches any television knows, Obama is taking full credit for a supposed saving and turnaround of General Motors. Given the enormous taxpayer resources that have been shifted from the taxpayers to the bank accounts of GM upper management and union workers, any claim of success from an economic standpoint is highly questionable, if not outright a lie. In stark contrast to Obama's boastful bullshit - something which has become one of his hallmark traits - it turns out the U.S. Treasury just released a new estimate of the cost of the bailout to Taxpayers. Originally Geithner was claiming $21 billion. He's now upped the ante to $25 billion: LINK. Please note: this is just an estimate, which has been no doubt highly polished and massaged to cover up the true cost.

HOWEVER, the Treasury estimate would not include the big loss the Government/Taxpayer has in GM's stock. The Govt still owns about 30% of the outstanding shares, the value of which has declined $6.1 billion since the GM IPO. Add that to the $25 billion cost estimate and we're now north of $31 billion. This assumes GM stock does not decline anymore before the Government unloads the rest of its stock. GM stock is down 39% since its November 2010 IPO. The Dow is up 18% in that time frame. Imagine what happens to GM stock if the Dow goes back into bear market mode, which it will in spades if the Fed does not print up a lot more money. If these numbers are considered "success" by Obama, I truly fear what a failure looks like...

Last, I wanted to delve briefly into yesterday's July retail sales report released by the Obama Government. It reported that retail sales were up .8% for July from June, which was a lot higher than the .3% Wall St. estimate. This number is highly questionable, and most likely substantially wrong. First, understand that this number is computed using questionable sampling methods which involve contacting selected retailers and having them "guesstimate" what their sales will be for July based on early month trends: Advance estimates are based on early reports obtained from a small sample of firms selected from the larger Monthly Retail Trade Survey (MRTS) sample. All other estimates are from the MRTS sample.

This description of the data sampling comes from the Census Bureau's report: LINK If you pull up that link, you'll see that the footnotes also describe the "adjustment" process the Government applies to the data to "seasonally adjust" the numbers. Translation: "we take questionable advance sales estimates and put them through our turkey grinder and adjust the results to fit our political needs." Furthermore, they "revised" lower the number from June, which mathematically makes the "calculated" increase for July look even greater.

In addition, the data released by the Government is not in any way supported by the actual sales tax receipts for July from California, the largest State in the country with 12% of the population and the 8th largest economy in the world. As you can see from this LINK, California's sales tax receipts were down 40% from July 2011 and were 33.5% below the estimated expectation. So you can see just how accurate "advance estimates" can turn out in reality. Quite frankly, a data sampling representing 12% of the U.S. population is likely a lot more accurate than the Government's loose advance estimate sampling.

Finally, a report released which contains Mastercard's retail sales data for small retailers for July showed that retail sales at small retailers plunged from July last year (consistent with the California data), but also dropped off month to month from June, quite contrary to the Government's claim: LINK.

So do you want to place faith in actual cash-register data from the State of California and from Mastercard, or place your faith in the Government? The truth is that the Government retail sales report is outright fraudulent.

Tuesday, August 14, 2012

Facebook Shareholders: See Your Future

The internet mini-bubble Round Two:

I mentioned to someone just yesterday that I think the Facebook IPO may be the biggest Wall Street pump-n-dump fraud I have ever seen or read about. Largest in terms of the dollar size and visibility. In that context, it was fraudulently marketed with willful and determined violation of the SEC new issue regulations (SEC Act of 1933) by both the underwriter, Morgan Stanley, and the upper management of Facebook; and it was fraudulently dumped on the unsuspecting - albeit greedy and ignorant - retail stock customers of Morgan Stanley and of the entire underwriting syndicate.

Not only are the above-mentioned players guilty, the Obama Government, specifically the SEC and the Justice Department are guilty for lack of enforcement of the SEC laws designed to protect the investing public from the predatory practices of Wall Street.

I mentioned to someone just yesterday that I think the Facebook IPO may be the biggest Wall Street pump-n-dump fraud I have ever seen or read about. Largest in terms of the dollar size and visibility. In that context, it was fraudulently marketed with willful and determined violation of the SEC new issue regulations (SEC Act of 1933) by both the underwriter, Morgan Stanley, and the upper management of Facebook; and it was fraudulently dumped on the unsuspecting - albeit greedy and ignorant - retail stock customers of Morgan Stanley and of the entire underwriting syndicate.

Not only are the above-mentioned players guilty, the Obama Government, specifically the SEC and the Justice Department are guilty for lack of enforcement of the SEC laws designed to protect the investing public from the predatory practices of Wall Street.

“When you see that trading is done, not by consent, but by compulsion – when you see that in order to produce, you need to obtain permission from men who produce nothing – when you see money flowing to those who deal, not in goods, but in favors – when you see that men get richer by graft and pull than by work, and your laws don’t protect you against them, but protect them against you – when you see corruption being rewarded and honesty becoming a self sacrifice - you may know that your society is doomed.” (Francisco D'Anconia, "Atlas Shrugged")

Monday, August 13, 2012

Housing: Look Out Below

The July employment and unemployment numbers published today, August 3rd, were worthless and likely misleading. What has been done in the last couple of decades to the reporting methodologies for monthly labor data, compounded by distortions introduced into the system from the economic collapse of the last five years, has left the heavily-followed employment and unemployment series seriously impaired as to significance, and potentially subject to direct political manipulation - John Williams, Shadow StatisticsI thought I would briefly summarize where I think we stand with the housing market. This will be conceptual, but conceptual based on links and data I have presented on this blog, and specifically data and trends so far this year. If I make any claims that need empirical back-up in your mind, please search the archives for 2012.

An ongoing debate in the media this year has been over whether or not the housing market has bottomed and is poised to move higher. This "debate" is largely skewed to toward the "bottom is in, blue skies ahead" camp, as that is the overwhelming editorial bias of the U.S. media at large. Unfortunately, the mass perception of anything economic is formed by looking at headlines and hearing sound bytes. And the sound bytes have been bullishly optimistic.

The truth is that, yes, there has been a slight bounce in home sales this year and slight bounce in prices. Please accept that this is nothing more than a proverbial "dead cat" bounce. After all, markets never go straight down to their eventual bottom - there's always a counter-trend "bounce" before the next leg down reasserts its ugly head. Housing is no different, especially when you factor in the trillions of dollars printed up and borrowed in order to keep the banks from collapsing and giving them room to "reload" on housing debt - albeit under much more stringent credit guard rails than the first time around.

In addition, record low mortgage finance rates, plunging home prices and a shortage in apartment inventory has fueled an investor binge on "investment rental" properties, which has created an illusion of "organic" home sales. Furthermore, the Government, using your tax money, has been subsidizing the cost of mortgages for those who refi, subsidizing the mortgage principal reduction programs designed to keep people in their homes and subsidizing the transfer of a massive amount of foreclosed homes from FNM/FRE to rental investors. This dynamic, combined with the massive foreclosure moratorium for most of 2011, has created the dangerous illusion of growth in home sales and low inventory.

Meanwhile, we have seen a big bounce in housing starts over the past year, fueled primarily by an usually large number of starts in multi-family units. This of course is the market adjusting to the shortage in apartment inventory. Over the next six months, this "shortage" will swing back to oversupply, as new apartment inventory competes with a large inventory of rental homes on the market. Interestingly, in driving around downtown Denver this past weekend, plus perusing the rental listings in craigslist, I have noticed that apartment rental prices has already started to soften up again.

Lower apartment rent will once again start another "negative feedback" cycle which will take house rental rates lower and ultimately force home prices lower. Oh ya, one more point on housing prices. Because of the nature of statistical measurement error, the claim that housing prices are actually rising is quite questionable. The various surveys have shown slight month-to-month increases during 2012. But, as anyone who has taken Statistics 101 knows (and being a U of Chicago grad, I had to suffer through some rigorous statistics courses), it is more accurate to characterize small changes over short periods of time as being attributable to data sample "noise" - measurement errors and the general nature of random sampling not necessarily being "random."

Therefore, what has been characterized as "rising prices" by the media, Wall Street and the Government is more likely to be some sideways bouncing along a tenuous level of support which was put in place with a couple trillion dollars in Fed/Government stimulus programs.

So what next? We are already seeing a significant acceleration in the number of foreclosures this year. I have posted a couple links recently which show this. Fannie and Freddie specifically unloaded inventory in order to make room for another big round of foreclosures. Big banks sitting on a massive number of McMansions in default are now being forced to start foreclosing. I have seen this in several high-end neighborhoods in Denver and personally know a couple people who have been tossed out of their big homes. In other words the "shadow" inventory of homes is starting to transition into real inventory. Not coincidentally, I have noticed a lot "for sale" signs popping up this month. Ironically, we are transitioning into a seasonally slower period for real estate sales. It will be interesting to see what the affect on prices will be by the end of this year by what I believe is going to be a large increase in "for sale/for rent" inventory.

Finally, to tie in the quote at the top from John Williams on unemployment, it is completely useless to even think about discussing a bottom for the housing market until this country figures out a way to fix the unemployment and joblessness problem. How can we possibly have true, organic demand for housing when the size of the labor force - the amount of people who are actually working - continues to shrink? Did I miss something magical about the demand for housing not being dependent on the number of people who can actually afford to buy a home?

Friday, August 10, 2012

The Insanity Intensifies

Here's the exact quote from Marc Faber: "If you put a gun on my head and you said 'you must choose either Mr. Obama or Mr. Romney,' I'd say 'please shoot.'"That's a game we used to play in the late 90's in which someone holds a gun to your head and says, "you have to sleep with either Oprah or Hillary Clinton," and the correct answer was "pull the trigger..."

I wanted to briefly touch on three issues which were exposed this week and which need to be rectified. First, Obama gave a speech in Ohio in which he claimed to have saved the U.S. auto industry and the associated jobs. If there is ever a political claim that needs to be "fact checked," it's that one. First, let's get one thing straight: Obama "saved" some uneconomically overpaid union factory jobs by legislating a massive transfer of $100's of billions in taxpayer wealth in order to prop up General Motors and Chrysler and to prevent GMAC - the financing arm of GM - from going bust.

And we don't know the ultimate cost of Obama's "save," but it is going to cost many multiples more than the benefits generated. We know for a fact that the Government is subsidizing the cost of leasing GM cars by guaranteeing the residual value of the car at the end of the lease. We won't start seeing the costs of this until the generation of Govt subsidized leases start expiring (next year to two for the most part). We also know that the Government is subsidizing the floor financing used by dealers, who then accommodate the channel-stuffing sales and massive inventories carried by GM dealers now. I've covered both of those in previous blogs.

Now the the Government is subsidizing the re-expansion of sub-prime auto-financing. With Government backing, GM acquired Americredit. Americredit is a company that was on the verge of blowing up from its nuclear auto loan portfolio. Now GM is using Americredit to drive sales: "GM Financial auto loans to customers with FICO scores below 660 rose from 87% of total loans in Q4 2010 to 93% in Q1 2012." Here's the LINK

It's only a matter of time before the Government support of GM backfires and the cost of Obama's "save" add $10's of billions more to the cost of keeping highly paid union employees well greased with high paychecks and bloated pension plans. This at the expense of millions of unemployed who would likely be willing to work at restructured auto manufacturers for a lot less compensation and at no cost to the taxpayers. And now Obama wants to apply this "business" model across several industries: LINK I don't even know how to respond to that other than to hope and pray that Congress stops him.

Second, the big banks have been instructed to come up with a collapse-prevention game plan in the event of a financial bomb detonating: LINK First, this tells us that something really ugly is getting ready to hit our system. We can only speculate what that might be so I won't go into that. But what I find interesting is that a big part of the "gameplan" is for the banks to identify assets they can sell in event of a market disaster. What's hilarious about this is that in 2008 the banks were unable to sell any crappy assets other than to the Fed and the Taxpayer (Treasury). This avenue only relieved the banks of a small portion of their illiquid assets. Now those assets have been marked back up to fantasy valuation levels in an endeavor to exploit liberalized accounting rules and manufacture paper earnings. I'm not sure why the Government could possibly think that these banks will have any chance in hell of unloading their crappy assets now unless the Government steps in once again.

My take on this is that it is nothing more than hypothetical exercise designed to justify the jobs, salaries and pension plan compensation of the Government idiots who came up with this idea. We will see soon enough that this hypothetical endeavor was a complete waste of taxpayer resources because unless the the Government wants to watch as the banks quickly collapse in the next financial crisis, the Fed will once again be asked to print a lot of money and Geithner will once again expropriate $100's of billions in taxpayer money and give it to the big banks for liquidity, salaries and bonuses.

Finally, I wanted to refute a claim made by Bernanke earlier this week. In a useless, rhetorical speech Bernanke made the claim that the growing Government-backed student loan burden was less risky than mortgage debt because student loan debt can not be discharged in bankruptcy. This is probably one of the most absurdly incorrect and patently disingenuous statements made to date by Bernanke.

First, as everyone knows, the student loan burden under Obama has gone parabolic. This chart shows the growth in student loans which are directly owned by the Government (sourced from John Williams' Shadow Statistics, who sourced it from the Fed):

You can click on the chart to enlarge it. And this is only half the story. The total amount of student loan debt outstanding is now at $1 trillion dollars. This is bank-financed debt that is guaranteed by the Government. I don't think anyone fails to understand that the motivation for Obama to ramp up student loan origination is that when someone leaves their job or gets terminated and then takes down a student loan to enroll at DeVries or University of Phoenix, they get removed from being counted as part of the labor force, thereby making the unemployment numbers look significantly better than they really are. Then, they graduate with a pretty much useless degree and a large student loan debt obligation and can't find a job anyway other than maybe at Starbucks or selling i-phones.

At any rate, I had a short debate with the editor of www.forexlive.com over Bernanke's statement. His argument was that they were more likely to pay their student loans than a mortgage because they can "strategically" default on a mortgage and get rid of it in bankruptcy. This is empty logic as you'll see in my reply, plus a lot people with student loans rent anyway. Here was my rebuttal:

People will pay for a roof over their head and a car before they’ll even think about paying a student loan. To begin with, everyone I know with one who isn’t making payments on their student loan is waiting for the Govt to eventually provide relief – which it will.The explosion in outstanding student loan debt since Obama took office is another massive, unpayable debt problem that will have to be addressed with massive currency devaluation and by the Government transferring even more wealth from the dwindling part of the population that actually does work and pay taxes to the expanding part of the population that is becoming increasingly reliant on Government transfer payments to make ends meet.

Even though strategic default makes sense, it’s not as common as the media makes it out to be. Most people default on their home because they simply can’t make the payments. The system let them take down too much debt. When you have Phd’s with $150k in SLMA debt working at Starbucks, you have someone who can make enough money for rent and transportation and a bag of weed who isn’t even thinking about making his SLMA payments…The idea that SLMA debt is higher quality than mortgage debt because it can’t be discharged in bankruptcy is typical ivory tower theoretical nonsense.

It's become more like the system in "Atlas Shrugged" by the day. Have a great weekend.

Wednesday, August 8, 2012

Definitive Primer On Gold/Silver Market Manipulation

"If I had to vote for Obama or Romney, I'd shoot myself" - Marc Faber

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

For those of you who have not seen it yet, I'm posting the interview of GATA's Treasurer, Chris Powell, with Lauren Lyster of Capital Account. For those of you who were unaware, Capital Account is hosted by RT.com, and it does some of the finest truthseeker reporting in media land. Ms. Lyster interviews Mr. Powell regarding the ongoing gold and silver manipulation, likely being conducted by a few big bullion banks like JP Morgan on behalf of Governments/Central Banks seeking to control interest rates and currency exchange markets.

As Chris points out clearly and with detailed references, agreements to manipulate the gold/silver bullion markets for controlling the currency exchange markets date back to the Gold Reserve Act of 1934, signed by FDR. As everyone likely knows, the "exchange stabilization fund" created by the Act was amended by Reagan after the 1987 market crash and enables the Government to intervene in any market at any time. By virtue of these facts alone, anyone who refers to market manipulation allegations as "conspiracy theory" is either completely ignorant of the facts or an interminable idiot. Market manipulation - and specifically gold and silver price suppression by the banks fronting for the Treasury/Fed - is part of the fabric of our system as legislated by Congress and signed by Presidents.

Here is the interview, and I would urge anyone who has not done so yet to take the time to watch the full interview. Mr. Powell explains clearly, in detail and with source documentation references, how and why the Government manipulates the gold and silver markets:

Anyone who takes the time to watch this video and then research the documentation cited by Chris - most if not all of it can be sourced at www.gata.org - will know more about how our financial markets operate than 99.5% of all humans. Certainly more than 100% of anyone who works at CNBC, Bloomberg or Fox Business.

Like every other Governmental attempt to control the markets and rewrite the natural laws of economics, the price suppression of gold and silver will ultimately fail, sending gold and silver to price levels that will shock everyone except the hardiest of gold bugs, and thereby signalling the onset of extreme hardship, poverty and totalitarianism in this country.

Monday, August 6, 2012

To Be Or Not To Be, Is The Silver Market Truly Free?

We now live in a nation where doctors destroy health, lawyers destroy justice, universities destroy knowledge, governments destroy freedom, the press destroys information, religion destroys morals and our banks destroy the economy - Chris Hedges, "Days of Destruction, Days of Revolt"Moment of silence for the end of the CFTC investigation into silver manipulation - or is it? In the back of my mind when I read last night's Financial Times article, behind the immediate swell of anger and frustration, I was wondering if the article was a "plant" by someone motivated to force the demise of the investigation. Apparently I'm not the only one who had that thought: LINK Certainly the big move higher in the silver market today indicates that the silver bulls aren't so sure about the validity of that news story either.

It doesn't take a high IQ to understand that the silver market (and the gold market) are heavily rigged by the big banks, likely fronting for a Government that is desperate to prevent a price run-up in precious metals from undermining the validity of its unbacked, paper fiat currency. But I was reminded last night of President Lyndon Johnson's remark back in 1965 when he signed The Coinage Act of 1965, which de-monitized silver and nullified the original Coinage Act signed by George Washington in 1792:

“If anybody has any idea of hoarding our silver coins, let me say this,” drawled the Texan “Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin.”Of course, the Treasury unloaded its silver in trying unsuccessfully trying to keep a lid on the price of silver, as it jumped from $1.29 to $49 within 15 years. Here's a good article describing the Johnson tragedy: LINK

Fast-forward to 2012, with silver having hit $50 briefly in April 2011 and the CFTC on its third round of investigation into the silver market manipulation. We've already had one insider come forward - Andrew Maguire - with proof that JP Morgan manipulates the silver market. It's getting to the point at which the Government will lose all credibility in its role as a regulator of the commodities markets if it cavalierly brushes aside its investigation, in the face of many years of proof painstakingly compiled by GATA, in addition to the testimony and information revealed by Mr. Maguire back in the spring of 2010.

The interesting question is, however, to what extent does JP Morgan manipulate the silver market on behalf of the Treasury and the Fed? Based on the degree to which JP Morgan is exposed to the silver market through its massive short position in silver on the Comex and its even more massive position in OTC gold/silver derivatives (per the quarterly BIS reports), JP Morgan is catastrophically exposed to one adverse move against its position in silver. Anyone who has been in charge of large trading/risk positions on Wall Street (e.g. me) knows that no one would take the kind of capital positions assumed by JP Morgan in silver without some kind of backstop guarantee - either inside information or deep pockets that don't care about magnitude of losses (the same analysis applies to a magnitude of many multiples with JP Morgan's interest rate swap derivatives positions, which are likely used to cap interest rates on behalf of the Fed/Treasury).

Anyone who dismisses the idea that JP Morgan would be involved in silver market or interest rate manipulation must have missed the news surrounding the LIBOR manipulation, which now dates back to at least 1991. It remains to be seen whether or not the CFTC will in fact do anything to prevent further blatant manipulation of the silver market. Many of us have our doubts and would be pleasantly surprised if it does decide to take action. At the end of the day, like all attempts to manipulate markets throughout history which fail miserably, the U.S. Government's endeavor in the silver market will ultimately end up with disastrous consequences for anyone short the silver market.

Friday, August 3, 2012

Friday Chart Porn: Value Play Of The Decade

Before I get to the good stuff, I wanted to comment quickly on today's employment report released by the Government. As we all know by now, the NFP (non-farm payroll report) is one of the most highly politicized and statistically manipulated economic statistics on the planet. It's gotten to the point at which it's become absurd in extremis the degree to which so-called experts get in front of the public and discuss this report as if it has any meaning at all. In fact, the only meaning it represents to me is the outrageous degree to which the Government is willing to stretch the truth in an attempt to exert control over the public. Unfortunately, for the actual 20% of the population that is unemployed/under-employed, this monthly three-ring circus of Wall Street economists, CNBC and the Government has turned truly tragic.

Now on to the good stuff...A long-time colleague of mine sent me this chart which shows the ratio of the XAU mining stock index to the price of gold going back to 1984. I have not seen anything like this in blogosphere or posted on the usual gold-bug aggregator websites. The XAU index is composed of 16 of the largest gold/silver mining stocks traded on the NYSE/Nasdaq. If you are interested, here's the list: LINK The ratio itself represents the value of the index in relation to the price of an ounce of gold:

Now on to the good stuff...A long-time colleague of mine sent me this chart which shows the ratio of the XAU mining stock index to the price of gold going back to 1984. I have not seen anything like this in blogosphere or posted on the usual gold-bug aggregator websites. The XAU index is composed of 16 of the largest gold/silver mining stocks traded on the NYSE/Nasdaq. If you are interested, here's the list: LINK The ratio itself represents the value of the index in relation to the price of an ounce of gold:

(click on the chart to enlarge)

As you can see, despite the 11-year move in gold, which has taken gold from $250/oz to as high at $1900, the market value of mining stocks in general has declined in relation to the price of gold by extraordinary amount since its peak in 1996, when the price of gold averaged around $380/oz and silver around $4.80/oz. Does this make sense, especially given that the large mining companies have steadily increasing their dividend payout ratio and throwing off record amounts of cash flow?

Either the market is pricing in the expectation of gold and silver selling off to the level where they started this bull market or the universe of mining stocks represents the value play of the decade.

Barring some miracle bestowed upon us by some fantastically imagined divine intervention, the financial, economic and political problems faced by the world are going to continue to get worse. This would argue against a big drop in the price of gold/silver and in support of the value theme.

The trigger for a massive inflow of capital into the mining stock sector will be the eventual discovery of this asset class by the large institutional funds - pensions, insurance companies, mutual funds, general-category money managers. As an asset class as a whole, institutional investors globally have less 1% of their asset base invested in the sector. At the peak in 1980, this allocation was over 6%. We're talking trillions in capital that will potentially flow into this sector, triggering a mania in mining assets that will at least rival, and likely exceed, the mania we saw in internet and tech stocks at the end of the last decade.

So for instance, the total market cap of all publicly traded mining stocks (gold/silver) is roughly $200 billion. This is less than the individual market caps of the top 15 stocks in the S&P 500. Fidelity has a small dedicated mining stock fund that has about $2 billion in assets. But as an institution Fidelity has over $3 trillion under management. At some point, just like with the tech bubble, Fidelity will move a lot of capital across many of its funds into the gold/silver mining stock sector. Sheer investor demand will require it. This trend will sweep across all large asset management companies.

I'm not going to try and put a timetable on when this investing shift will occur. But I will say that it is absolutely accurate to say that it's silly to discuss whether or not the precious metals sector is in some sort of "investment bubble" when most of the capital that could potentially flood into the sector and create a "bubble" has yet to do so. Have a great weekend.

Thursday, August 2, 2012

Central Bank Monkey Business

The thing about the Fed non-action is that every meeting they don't do something increases the likelihood they'll HAVE to do something at a subsequent meeting. - Dave in DenverWe wouldn't have the extreme volatility in the markets that surrounds Central Bank policy-decision meetings if analysts and traders bothered to think through the process of what happens if the Fed, ECB and Bank of England do not start the printing presses back up in a major way. I don't know of anyone, who if asked point blank how the western world solves its debt problem without extreme currency devaluation either by printing or default - and printing is in fact a de facto default - doesn't come to understand that the likely solution will be more printing. And a lot of it, quite frankly.

Hell, even yesterday it didn't take a painstaking syllable by syllable dissection of the FOMC statement released to realize that the Fed is firmly on track to print a lot more if the economy doesn't recover. Recover? LOL. On a real inflation-adjusted basis, the GDP never climbed out of a recession. Just ask the millions of people who have either gone on social security disability or took down student loans and went back to "school" since 2008.

At any rate, I wanted to share some thoughts on why many of us believe that the precious metals market is getting ready to take off again based on looking at the technical data embedded in the weekly Commitment of Traders report and daily open interest reports.

To review quickly, it is now well known and accepted by everyone who trades and analyzes the gold and silver trading on the Comex that a couple key large banks - JP Morgan and HSBC, primarily; Scotia, Barclays and Deutsche Bank secondarily - manipulate the trading in gold and silver by engaging in massive short-selling of futures on the Comex.

In fact, there has been no other market in history in which the ratio of the short interest position in the futures contract exceeds the available supply of the underlying commodity by the degree to which the short position in gold/silver futures exceeds the readily deliverable availability of physical gold and silver. In gold and silver the paper short positions on the Comex exceed not only the actual physical metal readily available for delivery in Comex vaults by several multiples, but it also exceeds any reasonable time measure of days of mining production globally of gold and silver. It's actually become absurd to the point at which most of us who understand the truth of the situation now wonder if the CFTC, SEC and Justice Department are in reality staffed and run by a group of Helen Kellers (deaf, dumb, blind).